Monetizing the Commute: How Voice is Poised to Capture Driver Attention and Wallet-Share

Image Credit: RAIN

What’s the value of 52 minutes of captive attention? That’s the average round-trip time that the American commuters spend driving to and from work five days a week. And it’s a potential gold mine for a host of companies that seek to use voice technology as a gateway to the attention and bank accounts of drivers.

The Healthy Technology Tension: Can vs. Should

By Eric Turkington, VP Strategic Partnerships at RAIN

To fully appreciate what this opportunity represents, it’s important to take a step back to appreciate how the character of our driving experience differs from the rest of our digital lives today. For most people, It’s hard to find a moment of our lives that has not been digitized with rich, interactive screen-based media. At home and at work, our mobile addictions deliver us constant access to content and utilities that simplify our lives, both of which have been efficiently monetized via hyper-targeted advertising or premium paid services. We’re saturated.

But for many, it is that transition between home and work where there remains a single sustained chunk of time that, by necessity, is unadulterated with screen-based engagement: the commute. For most drivers, the car remains a bastion of old-world, passive media made newly accessible via our cars’ head units – digital radio, streaming music, and audiobooks, smart navigation – thanks to Bluetooth and hard wired infotainment systems. Because so much of what we’ve come to know as interactive media remains screen-based, the car has remained a relative bastion of disconnectedness in the modern era. With the exception of voice calling and voice-enabled texting, our ability to compute while driving has been synonymous with our dangerous use of mobile devices when our eyes should be trained on the road. That’s about to change as the voice-first computing era makes its way into our vehicles in a big way.

Many might argue that humanity ought to preserve these last vestiges of digital solitude and leave them unpolluted by immersive technology, regardless of whether screens are part of the equation. There’s a lot to that argument but also merit to the notion that for many commuters, voice can transform otherwise “wasted” time into time well spent – whether that manifests as exercising our brains in new ways through gaming, enriching ourselves through interactive education, or simply promoting relaxation amidst wall-to-wall traffic.

What’s beyond dispute is that a new world of possibilities is around the corner for drivers, and between the companies who own the “pipes” and those whose services run through them, a lot of money will soon be made. Here’s how.

The “Front Door” Opportunity

Google profits massively as the gateway to the internet, the first point of routing for our intents. This position is so important to Google’s ad business that it, in turn, pays Apple $9B per year to be the default Safari search engine, ensuring high mobile traffic flows through it and not a competitor. With the car soon to become a new gateway to the digital universe for drivers, there is huge interest from a lot of players – OEMs, Tier 1s, and tech companies – in owning the first port of call for driver queries. Owning this prime position means having the power of which services get preference, which answers get provided, and eventually, how to charge brands and businesses to reach consumers in their cars. New data showing that 76% of consumers bring their preferences for home assistants into the car environment is promising for Amazon, Google, and Apple, whose smart assistants dominate the market. But OEMs and their Tier 1 suppliers are keen to maintain some semblance of control of their brand experience, and of the increasingly voluminous and valuable data that flows through their product.

There is also the possibility of multiple assistants becoming embedded in a given make and model, going beyond the existing precedent for giving consumers the option of CarPlay and Android Auto compatibility, depending on their mobile device of choice. An approach Maserati is experimenting with involves embedding three assistants that can each be accessed with a simple knob turn. If automakers embrace this multi-assistant model, they could go the manual, consumer-picks-the-assistant route like Maserati, or decide to serve as their own arbitration engine for any given voice query, calling up the voice service they believe best addresses a given command.

The Commerce Opportunity

Voice shopping and voice ordering are still nascent behaviors, but ones projected to grow at a rapid clip. The car is a reliable bet to accelerate that trend given the role it can play across the shopping journey. If we’re driving to a store or a restaurant, we can order in advance with voice and drastically speed up our visit, something more than a third of connected commuters are already doing for coffee and fast-food pick-up. If we’re leaving a store and forgot an item, we can simply use our voices to order it to be delivered or ready for us to pick up on our return visit.

We naturally make shopping lists on the way to the store, a ripe opportunity for brands to hawk their wares with deals as these lists get assembled. As many consumers shun visits to brick and mortar shopping centers entirely, the car might be the most natural place to get shopping done for routine fast-moving consumer goods, or even to plan for bigger purchases like gifts through product exploration and discovery.

Regardless of whether a brand is looking to transact from the car or simply make its brand and product available for engagement to the curious driver whose attention is rapt, every brand needs to consider the car as a vital point of reach with consumers. Compared to the rich interactivity on the horizon, the radio ad that still persists today will seem like a cute relic of a bygone era.

Perhaps the least businesses can do to capture commuter wallet-share is to provide basic information that can index on a voice search. A staggering number (96%) of local business listings still fail to provide accurate information via voice searches, according to a recent study on 73,000 Boston metro area businesses.

The Interactive Content Opportunity

Consuming content in the car is not new. The podcast renaissance owes much to the commuter audience, whether driving, walking, or taking public transportation. But the shift from passive consumption to active engagement opens a world of opportunities, in two distinct categories – storytelling & entertainment, education & training.

As opposed to accessing playlists or podcast feeds we’ve curated using our phones or computers, voice in the car will enable on-demand audio curation for entertainment. The ability to discover and queue up content simply by asking is transformational, as drivers can be impulsive creatures whose thoughts drift to things they wanted to listen to but never got around to downloading. On-demand access to content is one thing, but making that content interactive is another dimension that promises to unleash a plethora of creative potential. The ability to “double-click” on hearing content related to something you’ve just heard, such as related news or content by the same author, comedian or journalist, will be a perfect fit for the driver and their passengers, as would choose your own adventure narratives, much like Netflix is building into its programming.

Choose-your-own-adventures are just the tip of the iceberg for gaming dynamics to enter the car in a new way. Whenever a new platform arises, gaming tends to take off, and while gaming is one of the more popular categories of voice applications today, the voice-enabled car will be what truly unlocks the category.

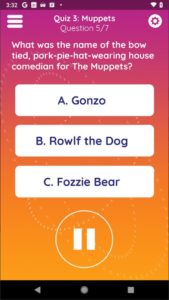

Image Credit: Drivetime

In an interesting statistical coincidence observed by Niko Vuori, CEO of Drivetime.fm, the amount of time Americans spent on mobile gaming in March 2019 equals the amount of time Americans spent driving alone: 2.5B hours. Drivetime.fm’s focus on real-time, commute-optimized trivia today is the tip of the iceberg for what they and other gaming companies will provide to drivers in the future, from role-playing to word puzzles to more involved executions – the equivalent of voice-enabled, auto-centric Pokemon Go, blending the digital and physical realms.

This opportunity for digging deeper via voice-enabled content navigation opens the door to another massive market: education and training. Whether drivers are seeking simple self-betterment via knowledge acquisition, studying for an upcoming exam, or going for formal certification in a new field, the chance to engage with the material while driving, in an interactive modality that incorporates quizzes and other gaming elements, is deeply enticing.

Many drivers for ride-sharing companies find themselves pursuing continuing education in addition to holding one or two jobs, and would jump at the opportunity to make their work-time productive for their broader educational pursuits between their fares. Companies like Uber and Lyft, for whom driver loyalty and satisfaction are key metrics of business health, would be wise to consider how voice can offer these enrichment opportunities as a value-added service.

All of these content opportunities beg the question of business model. Thus far, voice platforms have been loathe to allow advertising into the user experience for fear of alienating users as they acclimate to the new medium. Given the trends in streaming media today across music and video, it’s a good bet that freemium content models will come into the car, but there are also innovations in interactive audio advertising that could make ad-supported models more attractive. Instreamatic.ai is at the forefront of this movement, enabling content providers like Pandora to offer ads that users can talk to and which then drive them down the funnel. Early data indicates high levels of memorability and conversion compared to non-interactive audio ads.

The Productivity Opportunity

For businesses and workers alike, the prospect of making the commute truly productive is very attractive. Employees can reduce their potential workload upon returning home while freeing their minds and schedules to be more productive at work. In this regard, Microsoft’s Cortana may be an under-rated smart assistant for the road. As Amazon pushes its enterprise voice solution as relevant to customers anywhere an Alexa end-point may be (e.g., well beyond-the-office), Alexa for Business also promises to be a contender, whether Alexa is embedded natively or enabled via cheap Echo Auto hardware.

The use cases are too vast to list here: inputting and retrieving data on sales; calendar management; hearing pre-reads ahead of important meetings. These are the simple use cases that will open the door to more advanced computing for business, as natural language understanding advances and more complex commands can be executed with confidence.

What’s more, data indicates that people who use commute time to focus on “role-clarifying prospection” (defined as thoughts about their upcoming work) are less likely to be negatively affected by lengthy commutes to work. Using voice to do so seems like an obvious opportunity.

It’s clear there is enough money to go around in the emergence of voice in the car, and enough value to be added to the driver experience, that this evolution looks to be a win for all. But tapping into the potential of voice in the car is not without its challenges, which hold true universally, well beyond the commute.

The Contextual Data & Privacy Challenge

For voice experiences in the car to catch on and be truly useful and magical to the user, they must be powered by rich contextual data. Great experiences will match user data – about the consumer’s journey (where are they coming from and going to), intent (what do they seek to accomplish at this moment), social environment (alone vs. in groups), and more – with local data about the world the consumer is inhabiting (the nearest coffee shop, showtimes at the town cinema, etc.). To bridge these datasets requires both access to data but also intelligence to make sense of it.

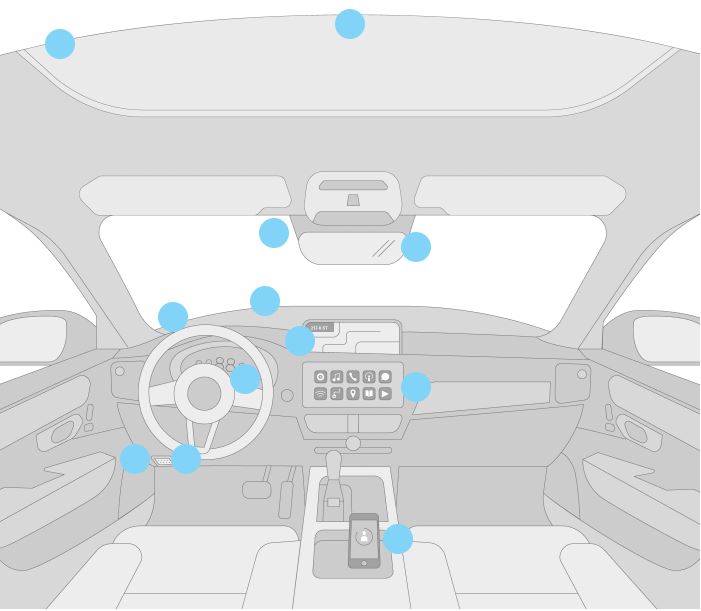

This is a major design and systems challenge for voice assistants, OEMs and the third-party brands offering voice-first services through them. There are no easy answers as to how each of these players will navigate balancing user privacy concerns with intense data collection practices that are needed to deliver personalized, seamless experiences in the car. Even today, there are more than 200 data points collected in connected cars, a number that will surely grow via voice assistants.

Image Credit: Consumer Reports

The Surface-Specific Design Challenge

For obvious safety reasons, voice experiences for drivers must follow different rules of design than other voice experiences. Attentional limits and cognitive load must be respected with greater care, and complementary screen-based experiences must be constrained so as to minimize visual distractions. Not surprisingly, Amazon has released its own design guide for the car.

Voice apps need to be auto-optimized, but also be smart enough to be adaptive to the context of the user in order to serve the right experience for the end-point (e.g., Echo Auto vs. Echo Show at home). Voice experience developers also need to ensure that users can fluidly access their voice services and content across end-points, enabling them to pick up where they left off. Designing for the car will not be as simple as applying a templated interaction model for an existing voice app, but fundamentally re-thinking the features and functionalities available to the user – many of which could have cause to differ between end-points.

While these are not the only hurdles to achieving realizing the voice-enabled future of the car, they are surmountable, and inevitably will be overcome as each player in the voice ecosystem comes to terms with the stakes involved. And once voice takes off in the car, it’s poised to have a ripple effect far beyond.

The “Killer Surface” and the Gateway Drug Effect

People often lament the lack of a “killer app” for voice that will take the technology into the next level of adoption. This may be the wrong thing to wait for when what’s really needed is a “killer surface” for the interface – and that is the car.

The necessity of using voice controls to get things done in the car will have a profound effect on the broader consumer adoption of voice. As soon as consumers grow accustomed to using a new interface to accomplish tasks in one setting, they start to expect they can use that same interface to accomplish the same or other tasks in other places. Children who grew up in the mobile-first era often falsely assume any screen they see is touch-sensitive. In the home, regular adoption of voice is hampered by the habits we’ve formed (screen-based, mobile-heavy) and the easy availability of these interfaces. In the car, consumers become more and more comfortable using voice interfaces and will have a greater awareness of all the things they can accomplish via voice. This fluency and knowledge will quickly permeate other aspects of their lives, from the smart speaker in the living room to the mobile device on the go.

If this holds true, the big winners will be the tech companies for whom regular engagement and app discoverability remain daunting challenges. Companies who invest in bringing their brands into the voice-first world will also benefit immensely from greater adoption of their services via voice.

Voice is on the move, and it’s going to be a wild, money-making ride.

Eric Turkington, VP Strategic Partnerships at RAIN

Follow @RainAgency Follow @voicebotai

Toyota Is Offering Retrofits for Apple CarPlay and Amazon Alexa Connectivity in Select 2018 Models

Voice Assistants in the Car with Alexa Auto, Nuance Automotive and Harman – Voicebot Podcast Ep 92

Alibaba is Developing Connected Car Apps That Let Drivers Order Food and More Using Voice Commands