Voice Assistant Adoption Clustering Around 50% of the Population

Voicebot recently broke down the rate of device adoption comparing smart speakers with smartphones. That analysis shows that smart speaker adoption was rapid but not as fast as smartphones when we take the launch of the Amazon Echo and Apple iPhone as the starting points. If you go beyond devices and isolate voice assistant adoption another interesting pattern emerges.

Initial Adoption of Voice Assistants Driven by Distribution

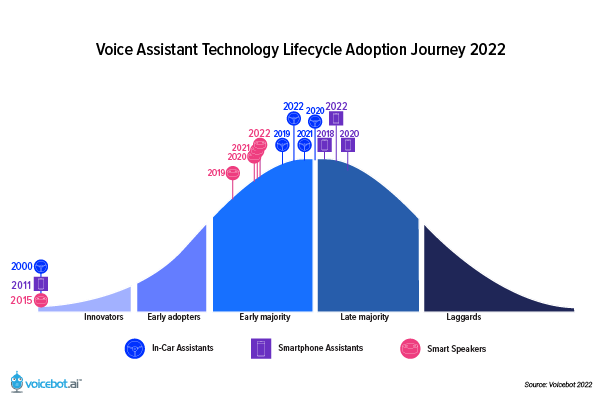

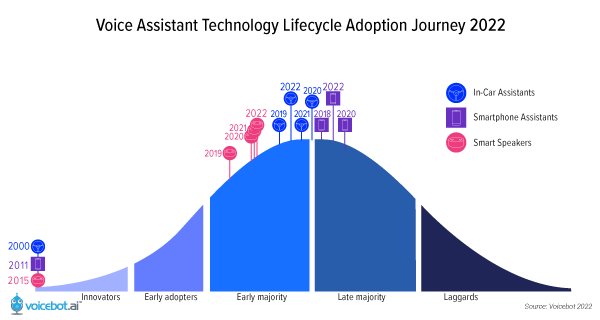

The general availability of consumer voice assistants first arrived in cars in 2000, smartphones in 2011, and smart speakers in 2015. As you can see in the chart below, the speed of adoption was very different across these devices. Much of this difference can be attributed to distribution. Few cars had onboard voice assistants until recently and even Bluetooth-connected smartphone voice assistants didn’t arrive until 2014. By contrast, smart speakers had voice assistants from the beginning and they began arriving in smartphones in 2011 and quickly spread to nearly all models within a couple of years.

Voice assistant proliferation in smart speakers was a function of smart speaker adoption. This differed from the car and smartphone which predated consumer voice assistants and added it as a feature later.

Voice Assistant Adoption

The In-Car Voice Assistant Consumer Adoption Report for 2022 depicted total adoption of voice assistants across the three leading device platforms offering access to the technology. The chart shows that voice assistant use in the car is just under 50% and on a smartphone, it is just over 50%. Smart speaker voice assistant adoption is limited today by the fact that only about 36% of U.S. adults have one of the devices. However, it is headed in a deliberate march toward that 50% mark.

This suggests that about half of device users will adopt a voice assistant when added as a feature. In case you are wondering how much overlap there is among devices, total voice assistant use including all devices is around 64% or about 9% higher than use on the smartphone alone. Monthly active users of voice assistants on any platform remains below 50%.

What it Means

Voice assistant adoption seems to have settled into a comfortable 50-60% of the population. The pandemic brought on a small decline in total users which was largely driven by lower access of voice assistants for on-the-go use cases. More notably, the use of voice assistants is no longer growing among the U.S. adult population.

This situation is not likely to change until some new, irresistible applications are introduced that drive more interest among the consumers that currently don’t bother with voice assistants. The most likely source of this change will be big brands adding voice to their existing products and independent mobile apps adding voice for domain-specific offerings. Peloton’s recently introduced voice assistant is an example of the former.

Predictably, the general purpose consumer voice assistant providers such as Amazon, Apple, Samsung, and Siri are more focused today on persuading existing users to increase their frequency and scope of use as opposed to expanding the market. In the automotive sector, there is still some competition for broader distribution for embedded assistants but this is now a market share strategy as opposed to a user base growth initiative.

Follow @bretkinsella Follow @voicebotai

The Rise and Stall of the U.S. Smart Speaker Market – New Report

In-Car Voice Assistants Reclaim Some Active Users as Pandemic Subsides – New Report

Peloton’s First Voice Assistant Arrives With New Peloton Guide Smart Camera