Google’s Smart Speaker Sales Decline in Q2 2019, Falls Behind Baidu While Device Shipments Rise 55 Percent Globally

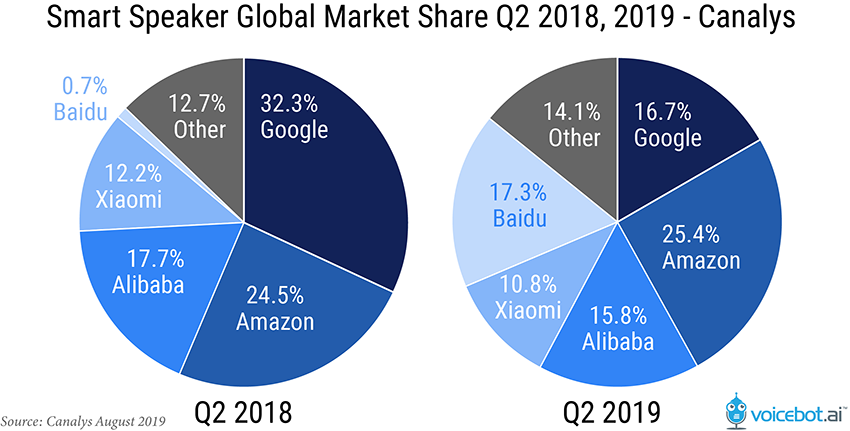

- Global smart speaker sales overall rose by 55% in Q2 2019 compared to Q2 2018 according to research firm Canalys.

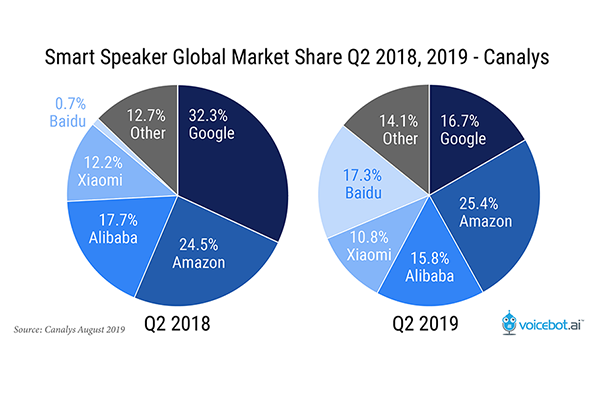

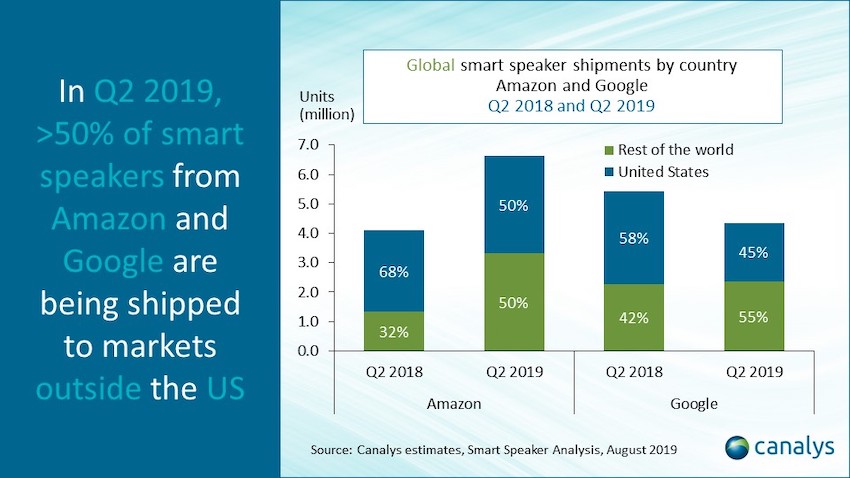

- Canalys also estimates that Google’s global smart speaker sales market share fell from 32.3% in Q2 2018 to just 16.7% in Q2 2019. That also reflected the sale of 1.1 million fewer smart speakers in Q2 2019 while all other vendors saw significant growth.

- Google’s decline was accompanied by a rapid rise by Baidu to climb from near zero to over 17% sales share in Q2 2019.

- Amazon took the top spot in global smart speaker market sales with 25.4% share and 6.6 million devices sold.

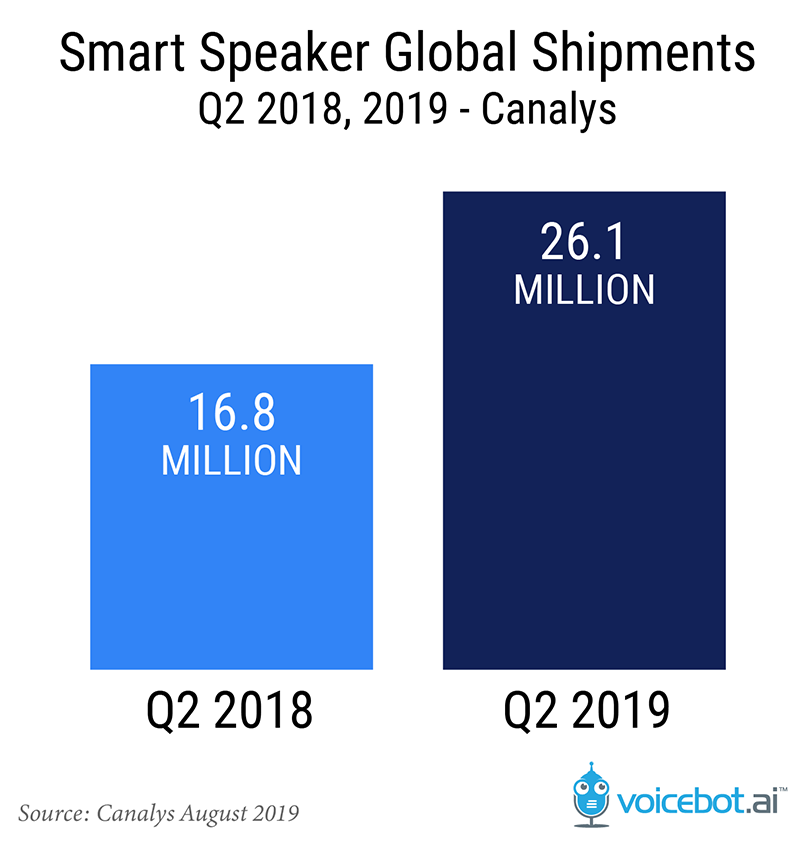

- Canalys also noted more than half of quarterly smart speaker sales are now outside the U.S. for both Amazon and Google.

- U.S. smart speaker sales declined 2.4% compared to the comparable quarter in 2018.

New data from research firm Canalys suggests Google’s share of the global smart speaker shipments in Q2 2019 trailed both Amazon and Baidu. Canalys estimates Amazon shipped 6.6 million smart speakers in the quarter compared to 4.5 million for Baidu and 4.3 million from Google. The figures place Amazon’s sales market share at 25.4% followed by 17.3% and 16.7% for Baidu and Google respectively. This is the first quarter that Google has not been first or second in global smart speaker shipments since launching a device in 2016.

Google’s sales were followed by Alibaba with 4.1 million units and Xiaomi with 2.8 million which accounted for 15.8% and 10.8% market share respectively. Other smart speaker makers shipped 3.7 million devices for a 14.1% combined share. Overall, smart speaker shipments rose 55.4% over the comparable 2018 quarter to reach 26.1 million units.

Google Smart Speaker Shipments Decline for the First Time

Notably, Q2 2019 marks not just Google slipping behind Baidu, but also that first time that the company has shown a year-over-year decline in smart speaker shipments for a quarterly total. In Q2 2018, Canalys says that Google led all smart speaker sellers with 5.4 million devices shipped and 32.3% market share. The Q2 2019 figures represented a halving of the company’s market share and a reduction of 1.1 million smart speakers sold. Google’s 20% year-over-year decline compares to every other vendor’s sales increase of at least 37%.

Factors Contributing to Google’s Sales Decline

Google may be suffering from three factors that are undermining its sales volume. First, the flagship Google Home smart speaker launched in 2016 and has not been updated. The value segment Google Home Mini followed in 2017 and has similarly not seen an update other than additional color options. By contrast, Amazon has regularly introduced updates to its core smart speaker portfolio approximately every two years for each device. Google is said to be working on an update to the popular Google Home Mini and that will likely arrive in the company’s annual hardware event in October. Google Nest Hub Max, a smart display designed to compete with the Amazon Echo Show and Facebook Portal, is also due to start shipping soon so we may see a turnaround as new products entice consumer interest.

Second, Google decided in Q2 2019 to change the product branding away from “Home” to “Nest.” The Google Home Hub was rebranded Google Nest Hub and all devices are expected to gain the “Nest” branding. This isn’t necessarily a bad idea, but it may be creating consumer confusion. “Google’s transition to the Nest branding while pivoting to smart displays proved to be a challenge, especially as it began rolling out its Nest Hub globally. Google urgently requires a revamped non-display smart speaker portfolio to rekindle consumer interest,” said Canalys senior analyst Jason Low.

No New Country Launches in Q2 2019

Another challenge for Google’s unit sales may be a lack of new country introductions in Q2 of this year. In April 2018, Google Home began shipping in Italy, India, Singapore, Spain, Australia, Ireland, and Mexico. There was also aggressive discounting in Q2 2018 with deals for purchases of multiple Google Home Minis. Maybe even more important, was the interest that Google Duplex, first demonstrated in May 2018, drove around Google Assistant capabilities in general. That has since launched but its features are limited to use from a smartphone.

Q2 2019 saw the introduction of Google Assistant in Belgium. However, Google Home smart speakers were not introduced into any new countries for the first time. The Google Nest Hub did start shipping in Canada for the first time, but the country has had Google-enabled smart speakers for two years and the smart display immediately received added competition from the new Amazon Echo Show 5. So, the lack of new country launches is the most likely culprit for depressed unit sales, but it is also worth noting that Amazon didn’t have any new country launches during the quarter and still experienced 61% year-over-year unit growth. Google’s Q3 and Q4 sales volume will merit close scrutiny to assess whether the decline is cyclical or representative of waning consumer interest.

Amazon and Google Smart Speaker Sales More Global Than 2018

Canalys also noted that Amazon and Google both sold more than 50% of their smart speakers outside of the U.S. in Q2 2019. That is the first time Canalys has found more international sales for Amazon and Google smart speakers.

This shift is particularly important for Google and Amazon because Canalys also reported that total smart speaker sales in the U.S. declined 2.4% to 6.1 million units in Q2 2019. That year-over-year quarterly contraction is also a first since smart speakers first came to market in 2014. Amazon was clearly able to manage this shift in demand more effectively than Google. Going forward, this will be another data point to monitor to see if U.S. sales begin to rise again and how non-U.S. sales trend for the leading smart speaker manufacturers.

Follow @bretkinsella Follow @voicebotai