China to Overtake UK and Germany in Smart Speaker Installed Base in 2018

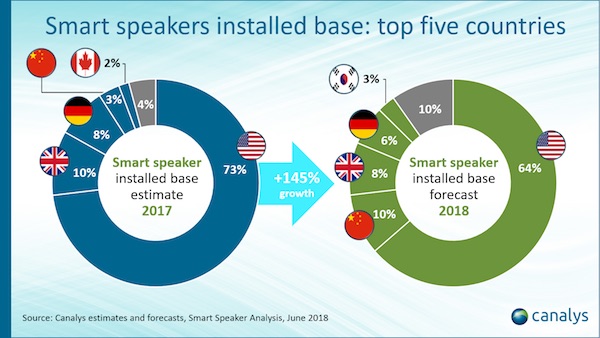

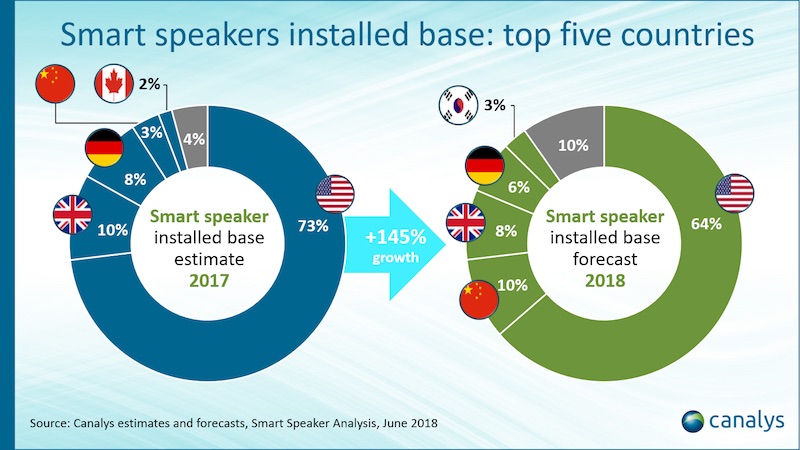

- China will rise from just 3% of global smart speaker installed base in 2017 to 10% in 2018.

- U.K. and Germany will fall back to the third and fourth largest smart speaker markets respectively in 2018 after being displaced by China for the second position.

- Korea will rise from a small portion of installed base in 2017 to become the fifth largest smart speaker market with 3% of global users in 2018.

China will overtake the U.K. and Germany in 2018 in smart speaker installed based according to research firm Canalys. The rise to 10% of global smart speaker installed base will place China as the second largest device market behind the U.S. which will maintain 64% share. South Korea will also vault past Canada to take the fifth spot in 2018 with 3% of global smart speaker installed base.

Chinese Smart Speaker Makers Will Compete Fiercely on Price and Features

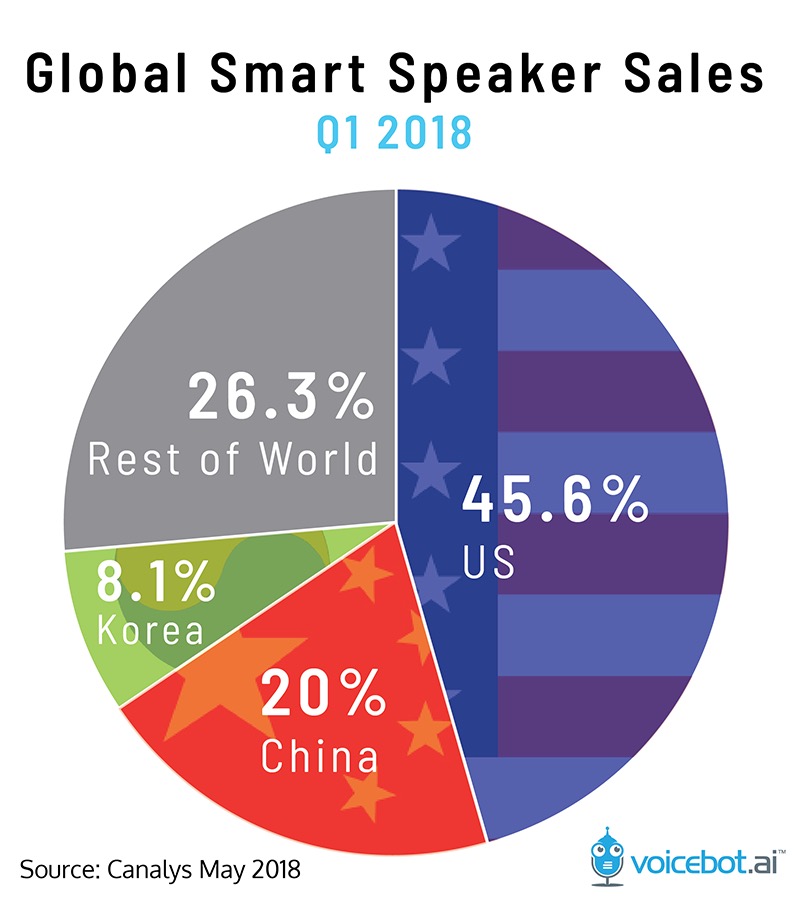

Canalys reported in May that China accounted for 20% of smart speaker sales in Q1 2018, behind only the U.S. which accounted for about 46%. The first smart speakers began shipping in China last summer so it has a lot of ground to make up before rivaling the U.S. in installed base of users. Canalys Research Analyst Hattie He commented:

“China is still a nascent market for smart speakers, but it is a sleeping giant. Local players, such as Alibaba and Xiaomi, are investing heavily. In the second half of 2018, sales promotions will be an important driver, as vendors anticipate a surge of shipments during the 6.18 Shopping Festival and Singles Day in November. As competition intensifies, Chinese vendors will expand their product portfolios to hit more price points and offer a greater range of capabilities … China has massive potential, with more than 450 million households, over three times the number in the US.”

Korea Rises on Rapid Smart Speaker Adoption

Korea also had a big Q1 2018 in terms of smart speaker shipments driving its global rise in the device category. Canalys reported earlier that Korean consumers accounted for 8.1% of smart speaker sales in the first quarter which placed the country third behind only the U.S. and China.

To date, smart speaker adoption rates globally have been driven primarily by country availability. Going forward, population size and technology adoption rates will be the biggest factors determining quarterly device sales and total installed base. When we look back on 2017, it will be seen as the year of the smart speaker in the U.S. whereas 2018 will be viewed as the year that smart speakers truly went global. The announcement about the research by Canalys can be found here.

Smart Speakers to Reach 100 Million Installed Base Worldwide in 2018, Google to Catch Amazon by 2022

Alibaba Doubles Smart Speaker Sales, Updates AliGenie Software and is Headed for Chinese Cars