Amazon Echo Users Skew High Income and Spend More on CPG Purchases Than Other Amazon Shoppers

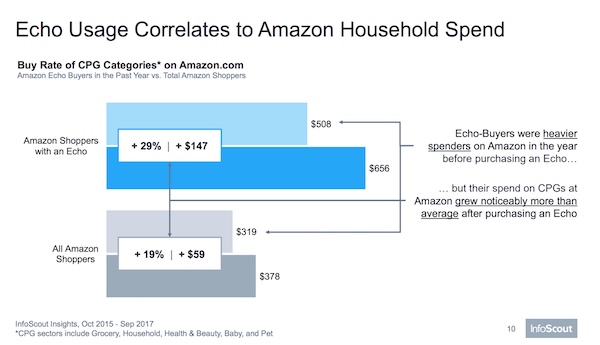

A new study of Amazon shoppers with Echo smart speakers shows they tend to be wealthier and spend more on consumer packaged goods (CPG) items than those without the devices. The report by InfoScout in collaboration with Alpine.ai found that Amazon Echo users spent about $508 annually on CPG items the year prior to acquiring the smart speaker and that amount rose 29% to and average of $656 in the year following purchase. By contrast, non-Echo owners spent $319 followed by a 19% rise in CPG purchases to $378 over the same two periods.

CPG items in the study are characterized as grocery, household, health and beauty, and pet product categories. Alpine.ai CEO Adam Marchick commented, “With 450 million voice enabled devices today and growing to over one billion by the end of this year, voice enabled commerce is something every brand and retailer should be participating in and building now.”

The story about growing voice assistant reach among consumers is well documented. There is now also a growing body of evidence that Echo owners spend more than average Amazon shoppers. Research firm NPD group reported in 2017 that Echo owners spent about 10% more on Amazon after purchasing a smart speaker. CPG represents only one category of spending and if the overall lift is still 10%, then CPG items are likely accounting for a large portion of the spending rise.

Echo Owners Are Higher Income and Buy More Frequently

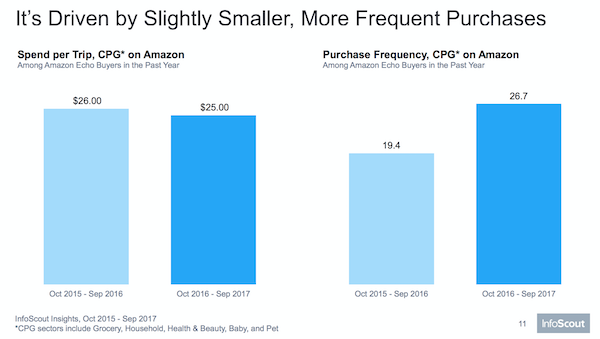

The higher base level of spending is not surprising given the other finding by InfoScout that Echo device owners skew higher income. However, smart speaker owners also increased their Amazon spending at least on CPG items in the 12 months after purchasing a device. This data along with the earlier findings by NPD Group suggest a correlation between device ownership and higher levels of spending. Another data point from the InfoScout study showed that Echo owners showed a small drop of 3.9% in average order size after purchasing a smart speaker, but their purchase frequency rose almost 38% driving much higher overall spending.

This rise seems consistent with the theory that the convenience of voice shopping via smart speaker will cause consumers to place more single item purchases than if they must go to the trouble of logging into a mobile app or visit a website. InfoScout CEO Jared Schrieber commented:

The data from the study demonstrates how voice-first devices are changing purchasing behavior.

“Millions of consumers are comfortable asking Alexa for shopping help and this is dramatically affecting the consideration, intent, and decision phases of the sales funnel. While voice commands are not even 20% of digital commerce right now, the uptake is dramatic, and brands should be making serious decisions about how to be present for Echo shoppers.”

Echo Owners are Also Likely to be Older, Male, Caucasian and Married

InfoScout also concluded that Amazon Echo owners tend to be a little older than average, caucasian males that are married. The gender imbalance correlates with Voicebot’s national survey of smart speaker owners that found 58% were male compared to 42% female.

Voice shopping is expected to grow to a $40 billion retail channel by 2022 according to OC&C. The findings by InfoScout are starting to show how that spending is breaking down and that the CPG segment may lead growth for voice commerce. You can review a report summary and access the full analysis here.

Voice Shopping is Monthly Habit for 11.5% of Smart Speaker Owners

Voice Shopping to Reach $40 Billion in U.S. and $5 Billion in UK by 2022