Is Apple Treating Voice Today the Way Blackberry Treated the iPhone in 2007?

Former Blackberry (RIM) Co-CEOs Jim Balsillie (left) and Mike Lazardis

There was once a company that had essentially created a market around a smart device, held dominant market share and its executives only saw the flaws in a new competing product. The Wall Street Journal reported in a 2015 retrospective (N.B. paywall), that Blackberry executives, the company was then called Research in Motion (RIM), were perplexed by Apple’s success. Co-CEO, Mike Lazardis echoed the mindset of his fellow executives according to the Journal report:

“Mr. Lazaridis believed the four pillars of BlackBerry’s success—good battery life, miserly use of carrier’s spectrum, security and the ability to type—still ruled in the new smartphone world and gave his company its competitive advantage. Two years after Apple’s launch, it still amazed Mr. Lazaridis that iPhone users had to cart around adapters to power up depleted batteries. His early prediction that Apple would cause AT&T headaches by using up its network bandwidth also proved right.”

In May 2008, Mr. Lazardis commented:

The most exciting mobile trend is full Qwerty keyboards. I’m sorry, it really is. I’m not making this up.

All of these arguments were logical. Blackberry had created the smartphone market, defined the key features everyone had to match, was growing its sales and held more than twice the market share of the iPhone a year after its launch. The logic behind the argument and the initial strength of Blackberry’s market position caused the company’s other Co-CEO Mike Balsillie to comment at the time:

It’s OK—we’ll be fine.

They weren’t. The market had changed. Apple had overnight created a new set of expectations that were more important than feature limitations around battery life and data consumption. A Reuters headline from February 2007 expressed this conclusion more starkly, “RIM Co-CEO doesn’t see threat from Apple iPhone.” This headline was drawn based on a Balsillie comment about iPhone in the article:

It’s kind of one more entrant into an already very busy space with lots of choice for consumers. But in terms of a sort of a sea-change for BlackBerry, I would think that’s overstating it.

What’s hard to overstate now is how important Blackberry was for the mobile industry in 2007. Revenue had grown from less than $600 million in 2004 to $3 billion in 2007, doubled again to $6 billion in 2008 and continued to rise to nearly $20 billion by 2011. Blackberry was on its way to 20% market share and was the high-end alternative to Nokia phones which commanded just over 50% share globally. Fast forward to 2017 and both companies had zero market share while Apple iOS and Google Android displaced the respective companies, but with more than 50% higher market share each.

Shades of Blackberry in Apple’s Approach

Apple CEO Tim Cook

Parallels from history are rarely exact replicas. Learning from history requires we look for similarities in patterns despite differences in details. iPhone introduced a new set of expectations around what a smart mobile device could and should do. Blackberry (i.e. RIM) maintained its focus on the existing market paradigm. Notably, Google saw what was happening even before iPhone launched, bought Android, replicated key iPhone features and surged to global dominance (more on that below). This was after Blackberry had pioneered what was then known as the smartphone market. Blackberry products did not include a touch screen but did incorporate a set of communication services and a web browser in 2004 and later added a track ball to navigate a screen. Three years later, Apple introduced iPhone.

Apple pioneered the personal voice assistant with Siri, first introduced in October 2011. Three years later Amazon launched the Amazon Echo smart speaker with the Alexa voice assistant. There is an obvious difference here if you focus on the devices. Apple was disrupting an existing market with iPhone and Amazon was creating a new market with smart speakers. Instead, focus on the voice assistant. Apple introduced Siri as a task helper on mobile. Early issues with performance expectations led the company to narrow the scope of Siri’s capabilities. The company decided to optimize Siri around a limited set of tasks that worked reliably and minimized consumer complaints.

Amazon introduced a voice assistant that the company said could do a few things, but did much more than consumers expected. Consumers responded favorably to the breadth of capabilities even if quality and reliability were not hallmarks of the initial launch. The company then improved performance, added capabilities and enlisted third party applications to further expand solution breadth. This was a near copy of Apple’s iPhone playbook. Alexa shifted consumer expectations of voice assistants. However, Apple’s Tim Cook doggedly focused on the existing paradigm in a 2016 comment:

We live in a mobile society. People are constantly moving from home to work and to other things they may be doing. And so the advantage of having an assistant on your phone is that it’s with you all the time.

A statement can be true while simultaneously betraying a flaw in a strategic vision about how the market will develop. In early 2017, Cook was quoted in a Business Insider article as praising Siri’s capabilities in terms of home automation and integration into a leading mobile OS.

We are leading the industry by being the first to integrate home automation into a major platform with iOS 10.

Siri clearly has advantages over Alexa in terms of mobile device access, but that is no longer the only important consumer touchpoint. The same article from Business Insider included the conclusion:

“Amazon especially is winning a lot of acclaim for locking up the burgeoning smart home market as an easy-to-use starting point for automated living. And Apple is looking like a laggard.”

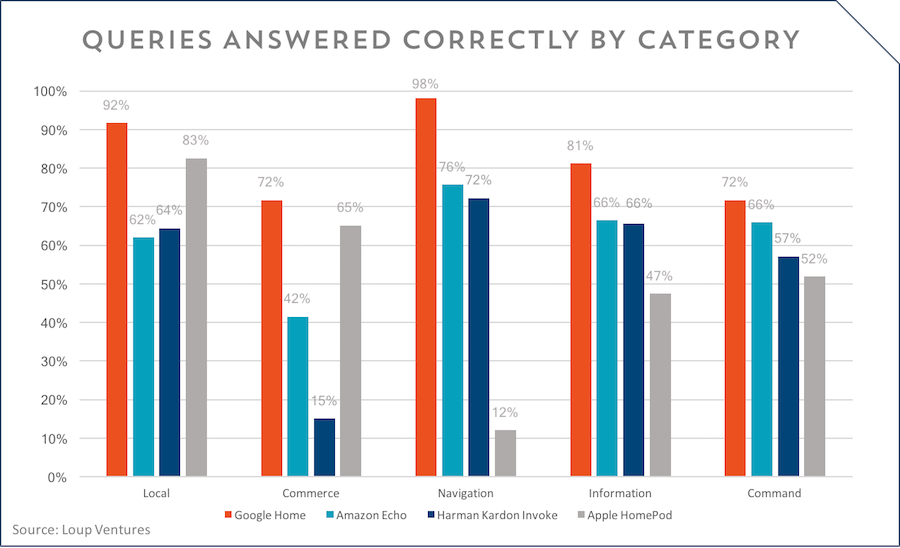

But, it’s not just home automation where Siri trails. Siri is not as good in its ability to answer common questions, has far fewer third party app integrations and it’s HomePod smart speaker simply doesn’t match the new set of consumer expectations for a home-based voice assistant.

“While Siri predated the rise of Alexa and Google Assistant, it hasn’t managed to keep up with their evolutions. Siri can be useful for short-burst needs, but it’s also slow, and limited, and frankly kind of dumb. Alexa’s not perfect, but it’s at least got depth.” WIRED, March 2017

“While Siri has improved in terms of her ability to process and respond to natural language, she still has some ground to cover to match the depth and breadth of Alexa and Google Assistant.” CNET, February 2018

“Although the HomePod is loaded with hardware and technology that make for some pretty incredible audio quality, the virtual assistant side of the speaker has been criticized for lacking the smarts of its competitors…In our testing, HomePod and Siri was the least capable duo out of the three smart speakers. Aside from known limitations such as Calendar access and phone call initiation (users can switch the output of a call to HomePod from an iPhone), Siri failed to correctly determine simple commands that Echo and Home were able to understand.” Apple Insider, February 2018

The Catch-Up Attempt

In 2008, Blackberry raced to introduce a touch-based device called Storm. It was launched on Verizon in the U.S. and I was joined by many consumers that promptly returned it for a different device. Storm may have been an engineering marvel given what was accomplished in just one year, but it simply showed everyone how hard it was to introduce a device comparable to an iPhone.

Apple hasn’t exactly been plagued by a raft of product returns, but reportedly has recently reduced HomePod sales forecast after the device came out two months later than originally announced and didn’t impress everyone with its claimed differentiator, audio quality. Many initial reviews claimed that HomePod did indeed exhibit impressive audio capabilities that far out shined other smart speakers. However, a number of competing reviews emerged suggesting that Sonos One and Google Home Max were actually better.

It is increasingly easy to say the company that created the modern voice assistant is today struggling with its voice strategy. The device-centric approach and revolving door of Siri executives are likely contributors. Apple has attempted to make HomePod about music, because the company’s product portfolio is about devices and their features. Siri as a feature doesn’t compete very well with the alternatives. The risk is that Apple will see this as a device problem when it’s really an AI assistant problem. Amazon and indeed Google both have devices but have reoriented their organizational focus around AI and voice assistants. The recent Apple hiring of former Google AI lead, John Giannandrea, seem like a new orientation. However, it is not clear that he will actually have authority to make changes and drive product direction. This should be watched closely.

Another thing to watch is Apple’s international strategy. Blackberry continued to see smartphone sales success internationally after the iPhone arrived in the market. However, it never did compete effectively in the U.S. where Apple quickly grew market share before ceding leadership to Google. If HomePod and Siri start a strong climb in market share and usage globally but struggle in the U.S. we could see a repeat performance as Amazon and Google use U.S. revenue to fund global competition.

Google is Proving to be is the Ultimate Fast Follower

The other player of note in both of these stories is Google. The company recognized early on the impact iPhone was having and set out to introduce comparable features. Google did this so well that Android marched systematically to 85% global smartphone market share. Two years after Amazon Alexa was first introduced, Google is following a similar playbook. It has set out to match Alexa features with Google Assistant. It has also introduced competing hardware devices that closely match those of the Amazon Echo product line.

The key difference between the early days of the smartphone wars and today’s skirmishes around voice assistant adoption is that Google has even more assets to leverage. Google’s extensive AI portfolio, natural language processing capabilities, knowledge graph, global telecom carrier and OEM device relationships, and worldwide presence have helped the company quickly close the gap with Amazon.

Apple is clearly a more formidable company today than Blackberry was in 2007-08. However, it’s rivals are also more formidable companies with what often appears to be limitless resources. When everyone has limitless resources, winners are often determined by strategy and time to market. Apple is trailing today in both categories. The company has tremendous assets to leverage and can quickly bring voice to many more devices in a tightly integrated product ecosystem than Amazon and Google. The challenge is and remains Siri. It’s time for Siri to get a new focus and new life. Blackberry didn’t recognize the market had changed. Is Apple making a similar mistake?

Apple Should Do 3 Things in 2018 to Make Siri Better for Everyone

Apple Cuts Manufacturing Orders of HomePod Due to Slow Sales According to Bloomberg