Apple Cuts Manufacturing Orders of HomePod Due to Slow Sales According to Bloomberg

Bloomberg’s Mark Gurman is reporting that Apple has lowered its sales forecasts for HomePod and cut manufacturing orders due to lower-than-expected consumer demand and excess device inventory.

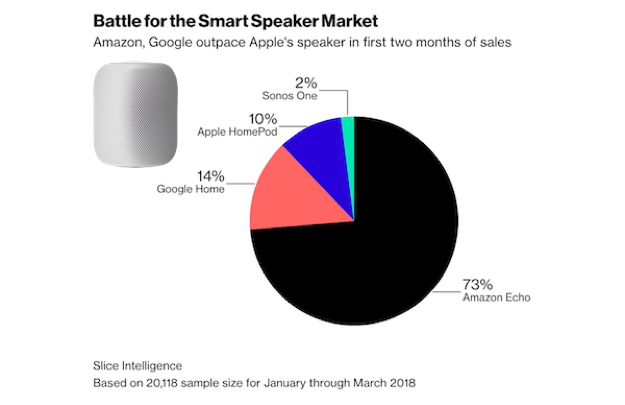

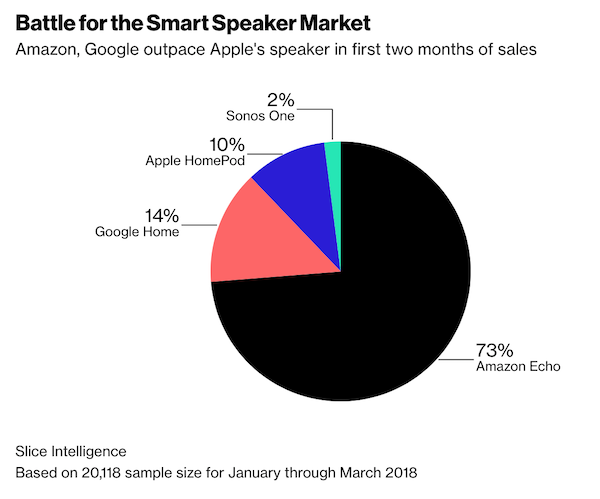

“At first, it looked like the HomePod might be a hit. Pre-orders were strong, and in the last week of January the device grabbed about a third of the U.S. smart speaker market in unit sales, according to data provided to Bloomberg by Slice Intelligence. But by the time HomePods arrived in stores, sales were tanking, says Slice principal analyst Ken Cassar…By late March, Apple had lowered sales forecasts and cut some orders with Inventec Corp., one of the manufacturers that builds the HomePod for Apple, according to a person familiar with the matter.”

The Flimsy Audio Quality Strategy

HomePod was marketed as having superior sound quality to smart speakers that were already in the market. This appeared to be a good strategy, because reviewers universally agreed that Siri is less capable today than Amazon Alexa and Google Assistant. If your smart speaker voice assistant is lacking, then simply compete on another criterion such as audio quality. However, that poses a problem when sound quality reviews emerge that suggest other smart speakers are as good or better than Apple HomePod. Many reviewers did suggest HomePod has excellent or even superior sound quality, but there was enough dissension to cast doubt on the claim. And, the Siri disparagement stuck. Bloomberg went on to report that:

Inventory is piling up, according to Apple store workers, who say some locations are selling fewer than 10 HomePods a day. Apple declined to comment.

HomePod Market Share Was 5x Sonos One

Let’s consider what this means. Canalys is forecasting 56.3 million smart speakers will be sold in 2018. A 10% share would be 5.6 million units. That is below the Loup Ventures forecast of seven million units but above the Strategy Analytics estimate of 3.8 million. It is not clear whether Apple can maintain a 10% share or hit the 12% forecasted by Loup Ventures. However, 3.8 million would be a 6.7% share. In addition, rumors suggest Apple is considering a lower priced HomePod model that could drive up unit volume. Finally, 10% market share by unit volume during February and March 2018 likely accounted for over one-third of total smart speaker revenue during that period. HomePod’s higher price point than most rival products puts Apple in a similar position as iPhone. It might not sell as many units as competitors, but still generates considerably more revenue.

The Bloomberg story is clearly bad news for Apple. However, HomePod’s challenges may have served as a wake-up call for the company. Just last week, Apple hired the Google’s most senior AI executive, John Giannandrea. The Information reported last month that the problems with Siri in many ways trace back to leadership challenges and inconsistency. Maybe the hiring of Giannandrea is a sign that Apple understands what it must do to compete in the new voice assistant landscape.

Follow @bretkinsella

Google to Be Smart Speaker Market Share Leader in 2022, HomePod to Pass 20 Million Units

HomePod Loses Again to Google Home Max and Sonos for Audio Quality Preference