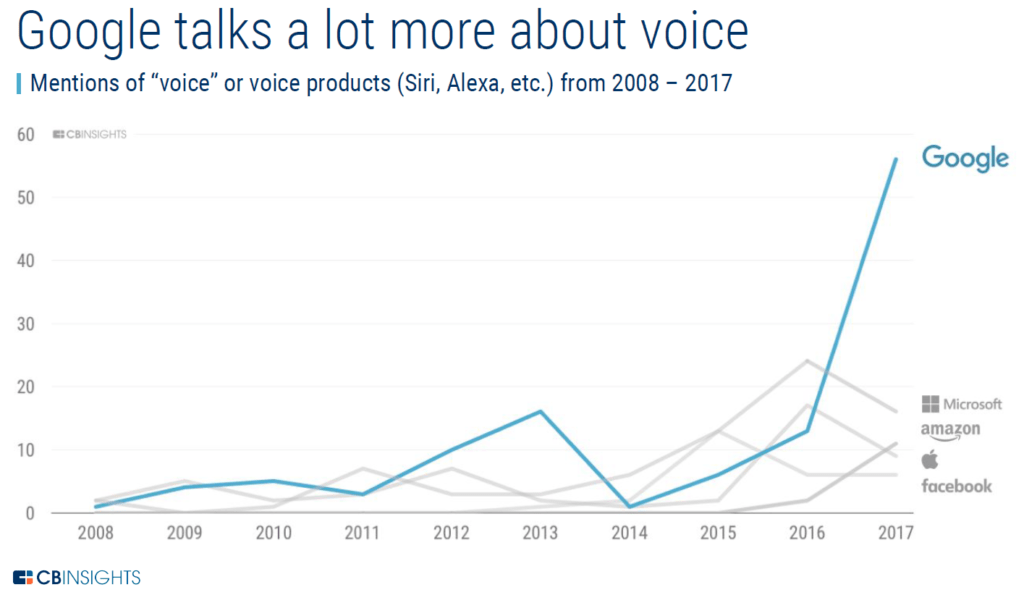

Google Mentions Voice More in Investor Calls Than Rivals

CB Insights has analyzed 10 years of investor earnings calls for Amazon, Apple, Facebook, Google and Microsoft. While most of its peers peaked in the mentions of “voice” or voice products in 2015 or 2016, Google had a spike in 2013, was lower for a couple of years and then was more than three times higher than its peers in 2017. What does this mean? Earnings calls are a time when companies clarify their interpretation of what has happened and what they foresee across their entire business. Apparently, Google must believe voice is central to its economic prospects both past and present.

Google Had Many Reasons to Mention Voice in 2017

In 2013, Google had good reason to be speaking with investors about voice. Google Now was the company’s early voice product that was already on Android and was added to iOS and desktops through Chrome browsers that year. At that time, Google Now was focused primarily around voice search. Google also had plenty of reason to mention voice in 2017. The company made Google Assistant available on hundreds of millions of smartphones, started selling Google Home in six new countries, introduced the Google Home Mini and Pixel Buds products and sold a smart speaker per second in the fourth quarter.

In addition, Google has more reasons that most to talk about voice. Amazon has Alexa and Apple has Siri, but Google has more than Assistant. DeepMind has voice technology, TensorFlow has clear applications for voice and voice search is headed toward 50% of all search. Given the current trajectory of voice adoption and Google’s economic reliance on search revenue, it is also the company most at risk. If a competitor were to become dominant in voice, it could handicap Google’s economic foundation. It is easy to imagine Amazon, Apple, Facebook and Microsoft surviving on their core businesses even without a strong position in voice.

A lower raw count of mentions of voice does not mean Amazon and Microsoft are ignoring the technology. That is clearly not true. The absence of talk about voice would be telling, but the number of mentions alone doesn’t suggest a bigger strategic focus on voice. However, the recent rise in mentioning voice technology does highlight how important this platform shift is to Google and how much they accomplished in 2017.

Strategy Analytics Reports Explosive Smart Speaker Growth in Q4, 30 Million Units in 2017