U.S. Falls to 46% of Smart Speaker Sales in Q1 2018 on the Rise of Alibaba, Xiaomi and Korean Device Makers

- The U.S. was the first market with AI-driven smart speakers and has dominated global sales and market share since 2014. However, new analysis by research firm Canalys found that the U.S. fell below 50% share for the first time in Q1 2018.

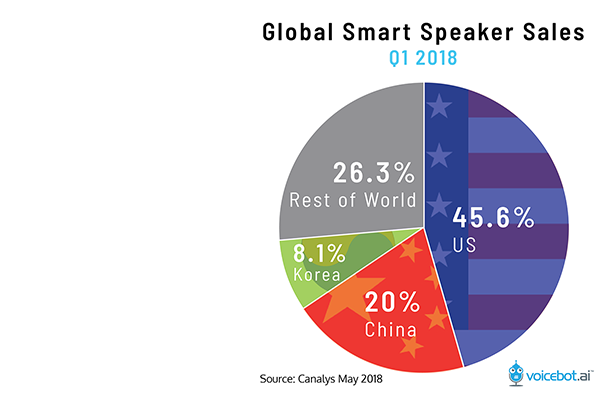

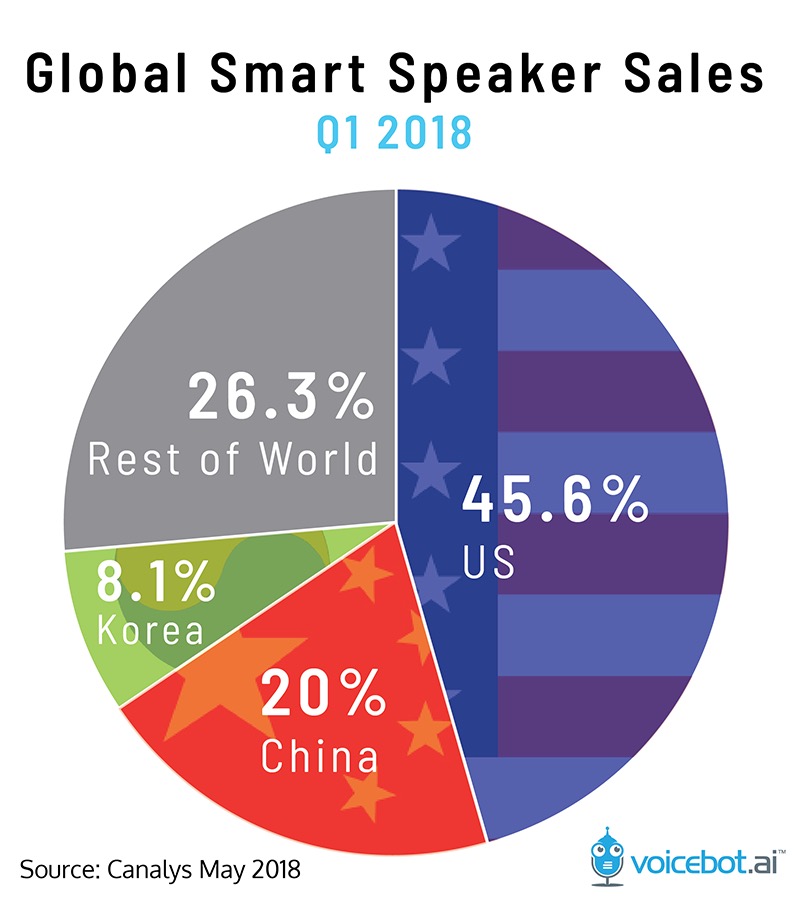

- U.S. smart speaker sales in Q1 2018 accounted for 45.6% of the global total while China was second with 20.0% and South Korea third with 8.1%.

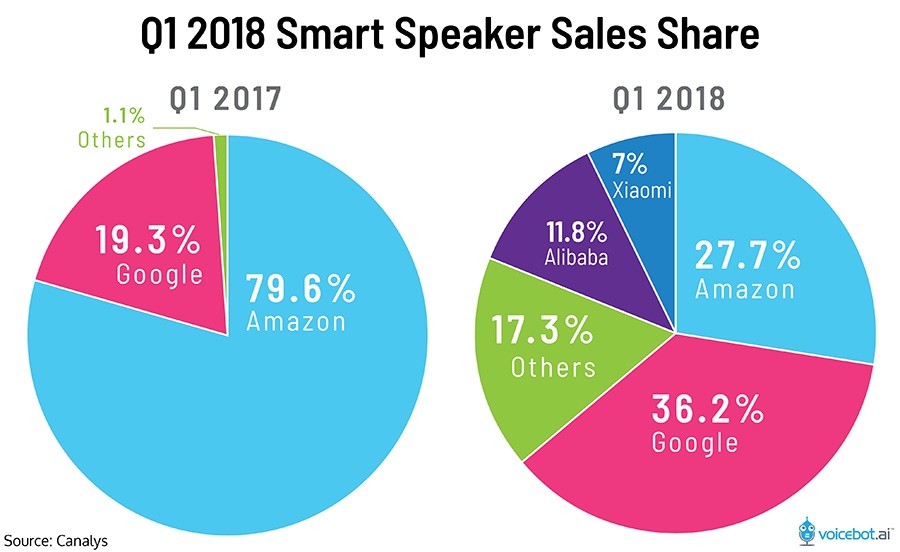

- Chinese smart speaker makers Alibaba and Xiaomi were the leading smart speaker manufacturers not named Amazon or Google selling 1.1 million and 600,000 devices in the quarter respectively.

Canalys dropped a bomb this afternoon by announcing that Amazon had fallen from the top spot in global smart speaker sales for the first time in Q1 2018. However, the same study had several other intriguing data points. The first is that the U.S. fell below 50% in global smart speaker sales for the first time. The top three countries for smart speaker sales were the U.S. at 45.6%, China at 20.0% and South Korea at 8.1%. The U.K. came in fourth but the data was not shared on sales volume for the country. Total smart speaker sales in the quarter were estimated at nine million units.

Alibaba and Xiaomi Lead the Pack Chasing Amazon and Google

Voicebot had reported earlier that Alibaba has sold one million Tmall Genie smart speakers in 2017 and then matched that number in the first quarter of 2018. The Canalys analysis raises the Q1 total by 100,000 units. All of those devices were sold in China. Second place in China went to Xiaomi with 600,000 units sold. Third place market share in China was JD.com, a division of Tencent, for its LingLong DingDong smart speaker.

Canalys research analyst Hattie He noted that Alibaba not only top the top spot in China for smart speaker sales, but ranked third globally behind only Google and Amazon.

Alibaba has done well to sustain its strong sales momentum…due to Tmall’s superior channel reach and Alibaba’s powerful marketing capabilities.

“Alibaba has done well to sustain its strong sales momentum since the 11.11 shopping festival in Q4 last year, largely due to Tmall’s superior channel reach and Alibaba’s powerful marketing capabilities. Awareness of smart speakers and their uses is growing steadily among Chinese consumers. But competition is building quickly for Alibaba, as IPO-hopeful Xiaomi takes to the smart speaker segment with much vigor in 2018.”

In Korea, the top two market share leaders in the quarter are also the top two telecom carriers in the country. SK Telecom sells traditional cylindrical smart speakers while rival KT sells the features embedded in television set-top boxes. Third place in South Korea was Line, maker of the popular social media app by the same name, with its three smart speaker models.

What all of this tells us is the U.S.-centric view of smart speaker sales is no longer a reliable gauge of global sales, adoption and use. Smart speakers now represent a global market and the U.S. will become an increasingly smaller slice of the pie going forward with Asian markets likely driving the most rapid growth.

Google Home Beats Amazon Echo in Q1 2018 Smart Speaker Shipments According to New Study

Alibaba Doubles Smart Speaker Sales, Updates AliGenie Software and is Headed for Chinese Cars