Cerence Beats Analyst Expectations, But Stock Drops Over Chip Shortage Warning

- Cerence’s $98.1 million in revenue beat analyst estimates of $97.9 million.

- Revenue rose 17% for the quarter from last year.

- Chip shortages leading to reduced car manufacturing led to a reduced prediction for next year and drop in Cerence stock price.

- Cerence offered guidance for the next quarter of 2021, projecting $9 million to $96 million in revenue or $31 million to $35 million with adjusted EBITDA.

Cerence Surge

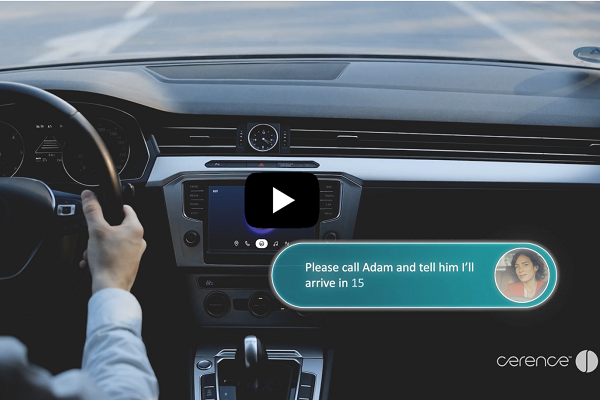

Cerence (CRNC), the automotive voice technology developer, announced Q4 FY2021 and financial results that beat analyst projections as has become a common occurrence. The company reported $98.1 million in revenue, beating the $97.9 million predicted by analysts. The company’s revenue rose 17% from the same quarter last year. The company’s success for the year rose to $590 million in FY2021, with $2 billion in backlog thanks to new partnerships and deals like with VinFast, Vietnam’s first domestic car company. New projects led to orders that represent a fifth of its total bookings. The company made headway with its plans for non-automotive mobility AI, scoring its first connected elevator contract.

“We finished the year strong, especially considering the production challenges our customers are facing due to semiconductor shortages. Our total company revenue grew 17% compared to the auto production growth of 9% over the same time-period, which is testament to the secular tailwinds, as well as, the innovative products and services we continue to bring to market,” Cerence CEO Sanjay Dhawan said. “We had another strong year for bookings at $590 million of which 20% were for our new products. These bookings included some key strategic wins, such as VinFast, and included multiple competitive takeaways. We also signed a contract with one of the top elevator manufacturers in the world to deliver voice AI technology and connected services creating the elevator of the future. This represents a key opportunity for us to expand into a new market with the potential to be a strong revenue contributor to our FY24 target for the new mobility market.”

Chip Shortages

While Cerence has a strong position from a technology and business standpoint, it is vulnerable to the global supply chain issues plaguing some of its partners. The silicon chip shortage worldwide is slowing outright pausing the manufacturing of many kinds of technology, including automobiles. Fewer new cars mean fewer new Cerence users, so the company lowered its previous expectations for revenue for the next quarter. Cerence projected flat sales in December, causing a 12.4% stock drop in the morning on Friday, before it started to regain some ground in the afternoon.

“As we look to fiscal year 2022, accounting for the industry headwinds due to semiconductor shortages and notwithstanding the approximately $23 million revenue reduction from the “legacy” contract, we still expect to grow above the IHS auto production forecast,” Dhawan said. “We expect to grow the business by continuing to deliver innovative products and world-class services for our customers. This focus on innovation and customer service allows us to maintain our market leading position in conversational AI and connected services for the transportation and mobility industries.”

Follow @voicebotai Follow @erichschwartz

Cerence Exceeds Analyst Expectations, Ups Next Revenue Prediction

Cerence Expands Voice AI Platform to Motorcycles and Elevators

Cerence Announces Smart Glasses Partnership for Motorcycle Voice Assistant