Amazon Maintains Global Lead in Smart Speaker Sales for Q4 2020 – Report

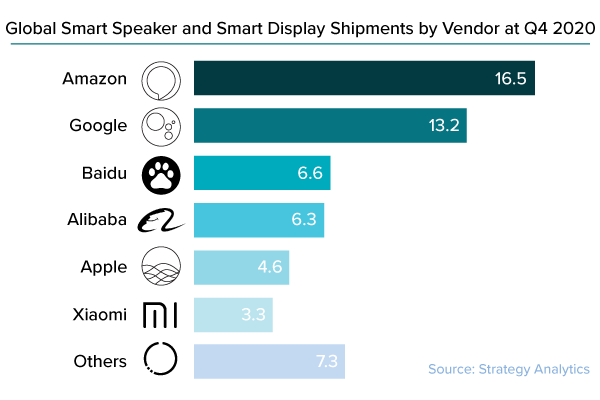

Strategy Analytics found that Amazon continued to lead in global smart speaker sales in Q4 2020 and actually expanded its lead over Google from Q4 2019. Amazon sold 16.5 million smart speakers and smart displays during the period followed by Google with 13.2 million, Baidu at 6.6 million, and Alibaba with 6.3 million. Apple came in the fifth slot with 4.6 million smart speakers sold in the fourth quarter.

Good News for Apple, Sort of

The results were particularly positive for Apple given that in the 2019 fourth quarter the company only sold 2.6 million devices and in the comparable period in 2018 the figure was 1.6 million. Apple has not typically had much positive news on the smart speaker front but the introduction of the HomePod Mini in October 2020 seems to have helped turn the company’s results in a positive direction. Voicebot data for the U.S. found that HomePod Mini helped drive a rise in Apple’s installed base market share and the new device already accounted for more than 40% of the company’s smart speaker customers.

Sales of 4.6 million is tiny compared to Apple’s other product lines and only accounted for about 8% of smart speakers sold during Q4 2020. For the full year, it is unlikely the company even generated a billion dollars in revenue. The good news is that the 8% performance in 2020 was up from a high of 5% in 2019. So the trend line is favorable.

Supply Shortages Suppress Smart Speaker Sales

Global smart speaker sales only grew 4.3% over the 2019 Q4 results which is far less than in 2018 and 2019 when the growth was 104% and 45% respectively. However, David Watkins of Strategy Analytics suggests this isn’t entirely due to lack of consumer demand.

“Considering all of the obstacles put in front of smart speaker vendors this year, the market has held up remarkably well. The delayed Prime Day shopping event delivered a boost to year-end demand and if it were not for component supply shortages the market would have fared even better. Stock supplies are expected to remain tight through early 2021 as the global shortage in electronics components lingers on. Assuming smart speaker manufacturers can weather that storm then the continued recovery in China and high growth opportunities in markets with low smart speaker penetration across Europe, Asia and Latin America should present them with a solid platform for growth in 2021.”

Voicebot data found slow smart speaker growth in the U.S. in 2020 that was driven in part by the pandemic repercussions and in particular a very slow Q4 compared to previous years. The component supply issue led to far less discounting and related promotions of smart speakers in Q4 2020 that certainly had an impact on demand.

Read the full announcement here.

Follow @bretkinsella Follow @voicebotai

Marketers Assign Higher Importance to Voice Assistants as a Marketing Channel in 2021 – New Report

Amazon Alexa Skill Store Gets Two Big Updates – One Was Unintentional