Voice Assistant Use Through Smart Hearables Earbuds Has Doubled Since 2018, Apple AirPods Extend Market Share Lead – New Report

Voicebot today released the Hearables Voice Assistant Consumer Adoption Report 2020 which provides a comprehensive analysis of hearables adoption as well as voice assistant use through the popular consumer devices. Hearables are best thought of as smart, wireless earbuds which among other features include voice assistant access. Apple’s AirPods are often thought of as defining the category and new data show that sentiment is justified.

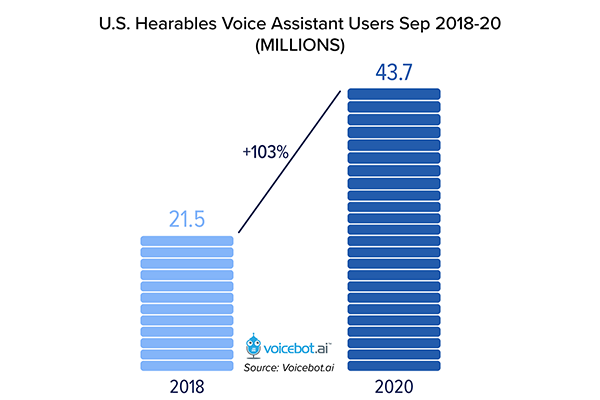

The new report is based on a survey of over 1,100 U.S. adults in October 2020 with comparison to similar data obtained in 2018. Consumer data show that hearables ownership by U.S. adults has risen about 23% during that period while voice assistant use through hearables grew by 103% from 21.5 million in 2018 to 43.7 million in 2020. The data show that hearables and voice assistant adoption are complementary technology trends.

Get Report

Apple AirPods Continue to Dominate Hearables Category

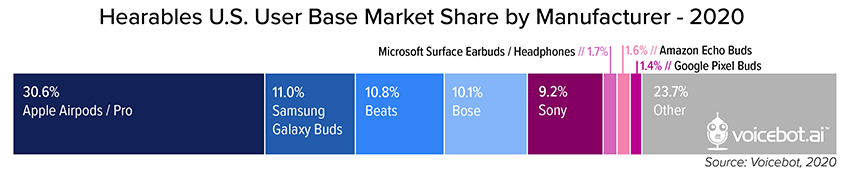

Even as the hearables category has become more crowded, Apple has extended its relative market share. In 2018, Voicebot estimated that AirPods commanded about 28% market share relative to its hearables competitors. That figure in 2020 has risen to over 30%. The introduction of AirPods Pro was certainly a factor. However, the price for the older models has also decreased and AirPods have the best user ratings in the product category on sites like Amazon.com. The devices also show lower levels of customer requests for improvement than other brands as detailed in several charts in the full report.

Samsung Galaxy Buds also are noteworthy in the report as these devices did not exist when we first measured consumer adoption for hearables in 2018. Promotions associated with new smartphone purchases helped Samsung move into second place in relative market share for hearables, ahead of several popular audio brands as well as tech giants Google and Amazon. This could eventually become an important asset for expanding consumer adoption of Samsung’s Bixby voice assistant. Google Pixel Buds actually lost share during the period according to consumer survey data while Amazon was a new entrant. Both show market share under two percent.

The Hearables Report for 2020

The Hearables Voice Assistant Consumer Adoption Report 2020 provides a unique lens on hearables adoption in the U.S. and compares growth in the segment between 2018 – 2020. Much of the data presented is based on a survey of over 1,100 U.S. adults in October 2020 which is compared to survey data from 2018. It provides an analysis of hearables use in general so it will be of interest outside the voice industry to observers of the consumer electronics and audio market segments.

Download NowIn addition, the report goes deep into voice assistant use through hearables. Data presented in over 30 charts include adoption totals, frequency of use, and key use cases both for general hearables users and specifically when invoking voice assistants. It also breaks out demographic adoption rates and relative success by brands such as Amazon, Apple, Beats, Bose, Google, Samsung, and Sony. Some of the charts in the report include:

- U.S. Hearables Voice Assistant Users Sep 2018-20

- Rate of Smartphone Voice Assistant Use by Setting or Activity

- U.S. Adult Voice Assistant Use by Personal Device 2018 – 20

- Monthly Active Voice Assistant Users by Device Compared to Ownership

- U.S. Adult Hearables Users 2018, 2020

- U.S. Adult MAU and DAU Share of Hearables Users 2020

- Hearables Frequency of Use 2020

- Hearables Frequency of Use by Gender

- Hearables Frequency of Use by Age Cohort

- Listening Time Distributed on Days When Hearables Are Used

- Time Per Day Spent with Media

- Average Listening Time on Days When Hearables are Used by Age Cohort (hours : minutes)

- Listening Time Distribution on Days When Hearables are Used by Age Cohort

- Hearables U.S. Market Share by Manufacturer

- Improvements Consumers Want for Wireless Earbuds

- Improvements Consumers Want for Wireless Earbuds / Headphones by Average Duration of Use

- Form and Styling Updates Consumers Want from Specific Hearables Brands

- Voice Assistant U.S. User Base by Personal Device 2018-20

- Voice Assistant Hearables Frequency of Use 2020

- Voice Assistant Hearables Frequency of Use By Gender

- Voice Assistant Hearables Frequency of Use By Age Cohort

- Growth of Voice Assistant Use by Device 2018-20

- Ratio of Smartphone Voice Assistant Users Employing Hearables for Access

- Voice Assistant Brand Market Share Through Hearables

- Voice Assistant Brand Market Share Though Hearables by Gender

- Voice Assistant Brand Market Share Though Hearables by Income

- Top Use Cases for Voice Assistants with Hearables

- Top Use Cases for Voice Assistants with Hearables by Gender

- Top Use Cases for Voice Assistants with Hearables by Age Cohort

- How Voice Assistant Access Impacts Perceived Value

- Smartphone Voice Interactive Ecosystem

To learn more about the report and Voicebot Research goto research.voicebot.ai.

Follow @bretkinsella Follow @voicebotai

Voice Assistant Use on Smartphones Rise, Siri Maintains Top Spot for Total Users in the U.S.

National Consumer Survey Reveals that a lot of Consumers Want Voice Assistants in Mobile Apps

Nearly 90 Million U.S. Adults Have Smart Speakers, Adoption Now Exceeds One-Third of Consumers