Global Smart Speaker Growth Cools in Q1 as Pandemic Leads to Declining China Sales, Amazon Retains Top Spot Says Strategy Analytics

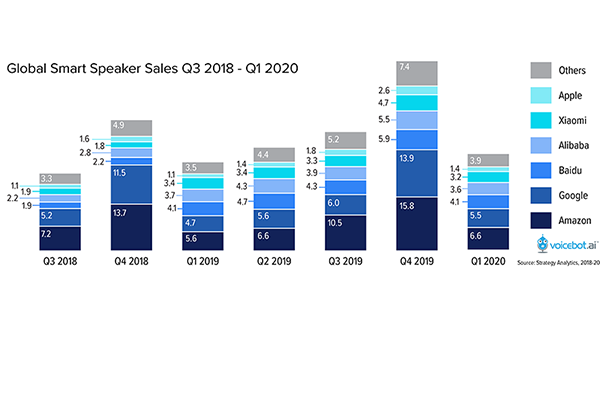

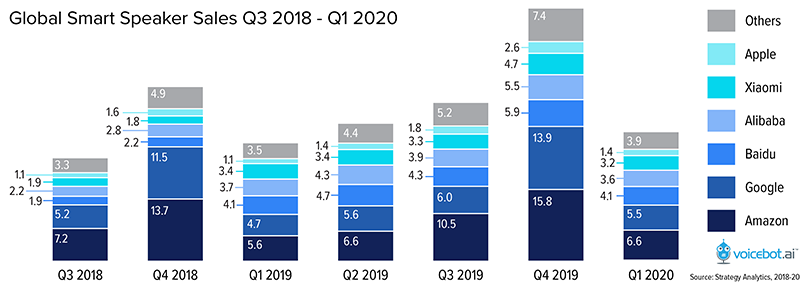

Over 28 million smart speakers were sold globally in Q1 2020 according to research firm Strategy Analytics. That is up from 26.1 million devices sold in Q1 2019 and down from a peak of 55.8 million sold in Q4 2019. Amazon sold the most smart speakers in the quarter as it has consistently since Strategy Analytics started tracking the segment with the exception of Q2 2018. Google and Baidu were second and third respectively as they have been for the past five quarters. Amazon sold about 1.1 million more smart speakers than Google during the quarter.

Slowing Smart Speaker Sales Growth

Strategy Analytics says global smart speaker sales were up just 8.2% in Q1 2020 over the comparable quarter in 2019. That is the lowest year-over-year growth we have seen so far for this device segment. The biggest factor was China. Amazon, Google, and Apple collectively notched 18.4% growth over Q1 2019 compared to a 2.7% contraction for the group of Baidu, Alibaba, and Xiaomi.

In Q1 2020, Chinese consumers purchased 10.9 million smart speakers. That was 300,000 fewer devices than in Q1 2019. Of course, China was also experiencing coronavirus-fueled quarantine which was impacting retail channels, supply chains, and manufacturing for most of the quarter. As a result, Baidu sales were flat year-over-year, while Alibaba and Xiaomi both sold fewer devices.

Will the U.S.-based manufacturers may be in for a similar experience as the leading Chinese vendors in Q2 2019? Keep in mind that China was impacted by quarantine measures for most of Q1 while U.S. and western markets were mostly impacted the last 3-6 weeks of the quarter. Any sales disruptions for Amazon, Google, and Apple are more likely to be disproportionately weighted toward the second quarter. It is unclear whether these effects along with global economic contraction might have an even longer-lasting impact on the segment.

David Mercer, VP, media and interactive home, commented, “Disruption to economies and the retailing environment will continue to affect demand dynamics for much of 2020, so vendors must continue to plan for volatility.”

There are a number of reports of increased smart speaker usage during quarantine policies in the U.S. and UK. That is not surprising given that consumers are home more and therefore around their smart speakers more hours per day. You would expect usage to go up. However, those figures don’t speak to whether there are more smart speaker owners. But, there may be reason for optimism according to David Watkins, director at Strategy Analytics. He said in a statement, “Much uncertainty lies ahead of course but the current stay-at-home conditions present an opportunity for smart speaker vendors and voice assistant operators to reinforce the value proposition of voice-first experiences.”

Amazon Retains Top Spot with Google Close Behind

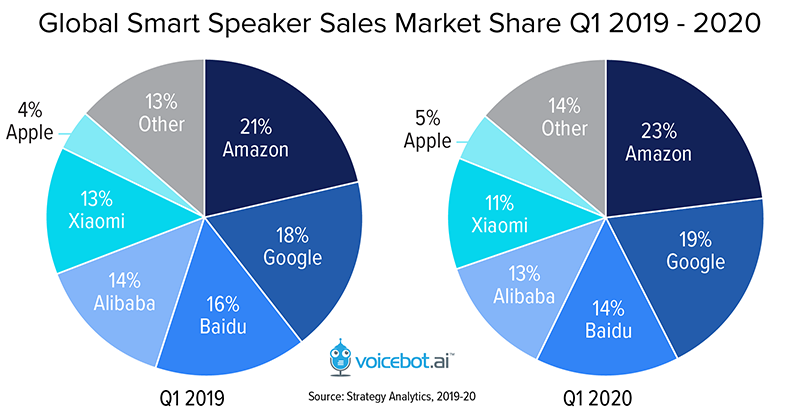

We noted that Amazon and Google retained the top spot in global smart speaker sales. It is worth pointing out that despite the China slowdown, sales share globally was very similar in Q1 2020 as it was in Q1 2019. Amazon, Google, and Apple collectively captured 47% market share in Q1 2020 compared to 38% for Baidu, Alibaba, and Xiaomi. Those figures were 43% and 43% respectively in 2019. All of the gains and losses were relatively small in the positive or negative direction. This suggests some stability in the market with the disproportionate coronavirus impact hitting China first in Q1 and an expected consequence for the U.S. device makers in Q2 2020.

The data also show that we have a solid Smart Speaker 6. You could argue the case for 5 given that is the number of vendors with double-digit sales share but Apple is always of interest, has seen some growth, and is the only player with products for both China and non-China markets. Sonos might eventually make the case for listing 7 vendors by name given its strength in the U.S. but as of today a Smart Speaker 6 seems like the right group to track for global analyses.

Follow @bretkinsella Follow @voicebotai

Nearly 90 Million U.S. Adults Have Smart Speakers, Adoption Now Exceeds One-Third of Consumers

Privacy Concerns Rise Significantly as 1-in-3 Consumers Cite it as Reason to Avoid Smart Speakers