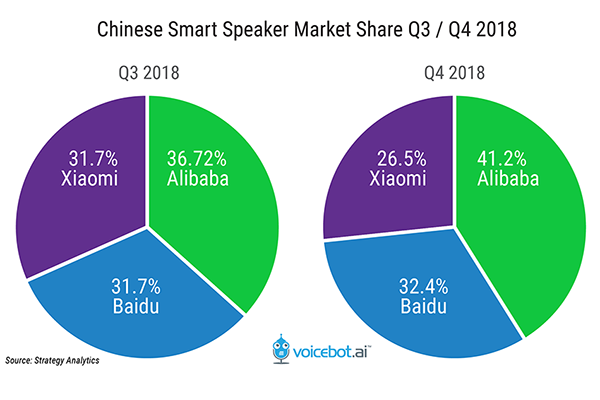

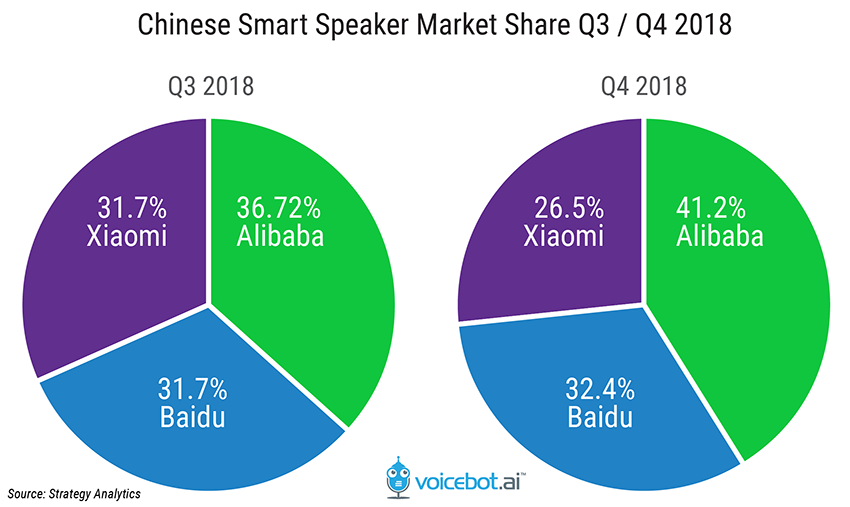

Alibaba Dominates China Smart Speaker Sales with 41.2% Share

- Alibaba accounted for over 40% of all smart speaker sales in China in Q4 2018, up from about 37% in Q3

- Baidu matched Xiaomi’s relative market share in Q3 and solidly surpassed it in Q4 at 32.4% to 26.5%

- In the first quarter of 2018, Alibaba and Xiaomi accounted for 94% of smart speaker sales in China, but Baidu upended the duopoly and now exceeds 30% of smart speaker sales turning the current competition into a three-horse race

Alibaba continued to lead in smart speaker sales share in Q4 2018 as it has since first introducing the Tmall Genie in the summer of 2017 according to new data from Strategy Analytics. While Alibaba’s Tmall Genie accounted for just 7.3% of global smart speaker sales in Q4 2018, it represented 41.2% of unit sales for the category in China compared to rivals Baidu and Xiaomi. That is up from 36.7% in Q3 2018. Alibaba was followed by Baidu at 32.4% and Xiaomi at 26.5%. There are other smart speaker offerings in China today, but their volume is small according to Strategy Analytics data so Voicebot conducted an analysis of the relative market share of the three leading device makers.

Baidu Rising

China’s smart speaker sales have risen quickly in 2018. In fact, Q4 2018 sales were about 11 times higher than Q4 2017 according to Strategy Analytics data. However, the biggest story of 2018 beyond rapid consumer adoption is the rise of Baidu in the second half of the year. A the beginning of 2018, Baidu had a smart display that was not selling in high volume and a premium smart speaker called Raven H that eventually ceased production. Things began to turn around in late June when Baidu introduced a low-cost smart speaker that sold out its first 10,000 unit production run in just 90-seconds according to company sources. Since then, unit volume has risen sharply culminating in 2.2 million units sold in Q4 2018.

In Q1 2018, Alibaba and Xiaomi commanded 94% of smart speaker sales in China according to Canalys. That figure fell to 68.4% by Q3 referencing the Strategy Analytics data and then 67.7% in Q4. The key beneficiary of this shift was Baidu which rose from less than 6% to more than 30% of device sales volume in the second half of 2018. Both Alibaba and Xiaomi have ceded market share to Baidu. In Q3, Baidu cut disproportionately into Alibaba’s market share, but by Q4 Alibaba had recovered somewhat and Xiaomi was impacted more and relegated to third place in China smart speaker sales volume.

Follow @bretkinsellaFollow @voicebotai

China Jumps to 29% of Smart Speaker Sales in Q3 2018, U.K. Hits 5% and the U.S. Falls to 42%