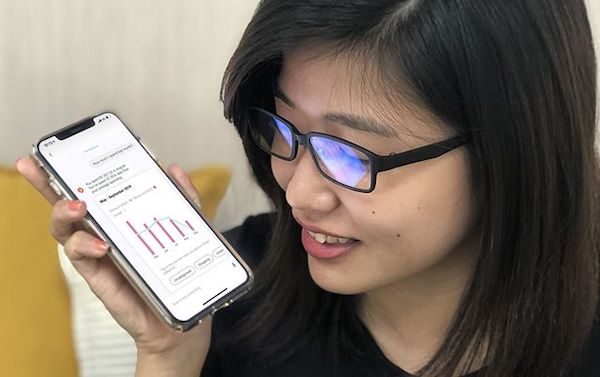

OCBC Bank in Singapore Taps Clinc to Add a Custom Voice Assistant to Mobile App

The OCBC Banking Assistant launched today in Singapore as a new feature of the company’s mobile banking app. While OCBC previously introduced a Google Assistant Action and some basic functions using Apple’s Siri in the app in 2018, the new mobile app-based assistant was created by the bank with the support of U.S.-based conversational AI startup Clinc. An announcement issued today revealed that the OCBC Banking Assistant was introduced on August 19th and has already handled 20,000 voice requests. The media release also went on to say:

“The customer speaks to the Assistant as if conversing with a human assistant – and the requested banking task gets done…Sourced through The Open Vault at OCBC, OCBC Bank’s Fintech and Innovation lab, the technology that powers the Assistant had been tested and is available for use outside Singapore. However, it had to be re-engineered for the local context – and integrated into the OCBC banking system – so that bills could be paid and account information provided seamlessly.”

What this means is that OCBC’s innovation lab brought in Clinc’s conversational AI solution for banks and trained it for specific use cases and localized the accent and vernacular recognition to Singapore. Users do need to tap the Assistant icon in the mobile app to start using it, but from there they can issue conversational requests to navigate a select number of banking tasks. Jason Mars, Clinc co-founder and CEO commented in an email to Voicebot:

OCBC Banking Assistant Features

The Singapore-based bank indicated that the OCBC Banking Assistant can today perform 11 discrete tasks ranging from balance inquiries to bill payment and locating the nearest ATM. A list of features provided by the company include:

– Balance & Transaction enquiry

- CASA balance

- Credit card details

- Transaction history

– Money Insights

- Monthly spending patterns

- Category spending breakdown

- Spending advice

– Bill payments

- OCBC credit card bill

- Other bank credit cards

- Billing organisations

– Change PIN

– Locate nearest ATM

Custom Voice Assistants in Banking

While most consumer and media attention is focused on general purpose voice assistants such as Amazon’s Alexa and Google Assistant, several banks have become early adopters of custom voice assistants that enable them to refine the user experience and control the data. Bank of America launched its voice assistant Erica in the U.S. in June 2018 and by the following May claimed seven million users and over 5o million “completed client requests.”

Capital One has a similar voice assistant named Eno. Through Capital One’s mobile app Eno is also addressable by voice, but can only communicate back with users via text. It lacks a natural language generation engine, but Eno goes a step further in offering assistant access through the web, via text message, on smart watches and even via email.

Both Bank of America and Capital One recognize that banking has a unique nomenclature, both technical and colloquial, that are difficult for general purpose assistants to reliably understand. Margaret Mayer, vice president of conversational AI at Capital One elaborated in a 2018 blog post saying:

“Financial institutions often have their own vocabulary: transaction, authorized user, fraudulent activity, and so on. But humans don’t usually think in those terms, and they certainly don’t text that way. That’s why, when creating Eno, Capital One’s intelligent assistant, we decided to build our own natural language processing (NLP) technology. It was important to be able to build Eno on a platform that deeply understands financial services terms, allowing us to deliver the best possible experience to our users.”

The banks also have many services that consumers struggle to locate through mobile and web menu structures whereas an assistant can bring a user directly to what they need instantly. Finally, bank leadership recognize the importance of having control over the security layer of their assistant and not outsourcing that to Amazon or Google. OCBC has followed a similar path, but in this instance adopted a white label natural language processing (NLP) solution, Clinc, to reduce time to market and leverage functionality that was already available.

Follow @bretkinsella Follow @voicebotai

Clinc Receives $52M in Funding to Grow Conversational AI Platform and Technology

Google Home Launches in Singapore, Devices Now in 10 Countries