How Important is First Mover Advantage for Amazon Alexa and Google Assistant? Very

First mover advantage may be very important for home-based voice assistants according to recent survey data. VoiceLabs conducted a consumer survey and found that only 11% of current users of either Google Home or Amazon Echo would buy a competing device. This led the VoiceLabs research team to conclude:

Therefore, while not a winner-take-all market, in 2017 VoiceLabs predicts it will be a winner-take-entire-household market. This puts pressure on the hardware providers to distribute devices quickly. Amazon excels at selling third-party hardware and consumer electronics, giving it an advantage in this distribution race.

This seems logical especially when you consider that consumers are likely to start adding the devices into multiple rooms throughout their homes and that the services offered on the platforms differ. Both of these factors increase the perceived switching costs. There may be some increased specialization of the devices which might mean a single version of a competing solution winds up in a household for a specific task, but this would likely be an exception case.

This seems logical especially when you consider that consumers are likely to start adding the devices into multiple rooms throughout their homes and that the services offered on the platforms differ. Both of these factors increase the perceived switching costs. There may be some increased specialization of the devices which might mean a single version of a competing solution winds up in a household for a specific task, but this would likely be an exception case.

Who Has the Advantage in the Winner-Take-Household Race?

Amazon clearly has an advantage if the winner-take-household scenario plays out for four reasons:

Amazon clearly has an advantage if the winner-take-household scenario plays out for four reasons:

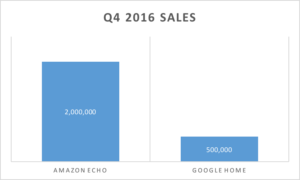

- It has an installed user base that is more than ten times larger than Google Home today

- It has about 100 times more voice applications for Alexa which makes it more attractive to many consumers

- It has Echo Dot priced at under $50 which makes it less expensive to install Alexa throughout the home than purchasing multiple Google Home devices at $129 a piece

- Amazon has dozens of third-party manufacturers using Alexa Voice Service which can deliver a common experience across multiple devices that can address a wider range of consumer preferences

This is Not Android But Google Has a Shot Because of It

In the last round of platform wars, we saw that Google became the market-share winner even though it was late to market. Android today is estimated to command over 85% of the global smartphone marketshare. However, this is not Android. Android was free, making it suitable for lower cost devices and it was made available to third parties while Apple maintained premium pricing for iPhones and iOS remained off limits to other OEMs. These restrictions provided a market opening for Android to enlist manufacturers to build competing devices in both premium and low price segments. However, Amazon is not offering this market opening to Google. Amazon is working directly with third party manufacturers and offering low price devices itself.

The advantages that Android was able to exploit are simply not available for Google Home. However, Android provides a key wedge for Google because of Google Assistant on the smartphone. Amazon may know your shopping preferences, but Google through its Gmail, calendar, maps, Waze and Chrome services has a lot of context about people and their daily lives. To the extent the company can fulfill the promise of integrating these services seamlessly into Google Assistant, then there is added value for many Android users already in the ecosystem to adopt Google Home over the Echo. The 1.6 billion Android users provides a very large market of users that you would assume would find added benefit from choosing a Google device. The announcement last week that Google Assistant is now available to about 30% of Android users is the first big step in that direction. Amazon simply doesn’t have this asset to leverage. This means that Google has a decent shot at winning new consumers despite Amazon’s early mover advantages and could even be viable to drive switching from Echo to Home over time.

The advantages that Android was able to exploit are simply not available for Google Home. However, Android provides a key wedge for Google because of Google Assistant on the smartphone. Amazon may know your shopping preferences, but Google through its Gmail, calendar, maps, Waze and Chrome services has a lot of context about people and their daily lives. To the extent the company can fulfill the promise of integrating these services seamlessly into Google Assistant, then there is added value for many Android users already in the ecosystem to adopt Google Home over the Echo. The 1.6 billion Android users provides a very large market of users that you would assume would find added benefit from choosing a Google device. The announcement last week that Google Assistant is now available to about 30% of Android users is the first big step in that direction. Amazon simply doesn’t have this asset to leverage. This means that Google has a decent shot at winning new consumers despite Amazon’s early mover advantages and could even be viable to drive switching from Echo to Home over time.

Google Has Work to Do to Reach Alexa Parity

However, evidence thus far suggests that Google isn’t quite there yet. While Evercore estimates Google shipped 500,000 Google Home units in Q4 2016, Voicebot and VoiceLabs estimates both peg sales of Echo devices during the same period as 2-3 million. Google has some potential longer terms advantages but they may take longer to develop. Before last week, Google Assistant was only available on Pixel phones. Evercore suggested just over 550,000 were sold in 2016. That means very few people could truly take advantage of what would appear to be Google Home’s biggest differentiator. The introduction of Google Assistant this past week to Android users with the Nougat and Marshmallow OS versions changes that equation. The questions is how long adoption will take. The longer the adoption delay, the more time Amazon has to build out its lead and lock-in those households that say they won’t switch.

However, evidence thus far suggests that Google isn’t quite there yet. While Evercore estimates Google shipped 500,000 Google Home units in Q4 2016, Voicebot and VoiceLabs estimates both peg sales of Echo devices during the same period as 2-3 million. Google has some potential longer terms advantages but they may take longer to develop. Before last week, Google Assistant was only available on Pixel phones. Evercore suggested just over 550,000 were sold in 2016. That means very few people could truly take advantage of what would appear to be Google Home’s biggest differentiator. The introduction of Google Assistant this past week to Android users with the Nougat and Marshmallow OS versions changes that equation. The questions is how long adoption will take. The longer the adoption delay, the more time Amazon has to build out its lead and lock-in those households that say they won’t switch.

Huawei, Alexa-enabled Apps and the Amazon Smartphone Onramp

Amazon is not totally out of luck when it comes to smartphones as a channel for its Alexa virtual assistant. Sensory is building Alexa integration into its Bluetooth headset controllers that will be compatible on both iOS and Android devices. Huawei has a stated mission to become the top smartphone company by marketshare and its Mate 9 model includes Alexa. Amazon still lacks the range of context that Google apps and services have today, but it is rapidly gaining distribution via the smartphone and could add context through partnerships with app developers.

Could We See Multiple Assistants?

Another likely outcome is that many people will have one virtual assistant in the home and one associated with their smartphone. The home-based virtual assistant will service the household and maintaining user context won’t be its primary goal. The smartphone-based virtual assistant will be the personalized service which will provide added value related to user context and be always available — at home and while mobile. In this way, the household assistant could well become a family decision as opposed to the decision of single person with a particular preference.

Virtual assistants are going to represent a very large market. There may only be 11% of households adopting more than one home-based virtual assistant device and that provides a large incentive for both the first mover, Amazon, and the fast follower, Google. However, the smartphone-based personal virtual assistant segment may well develop separately from household device adoption and provide a different way for companies to stake out a position in the market. Apple and Samsung must be counting on it.

Follow @bretkinsella