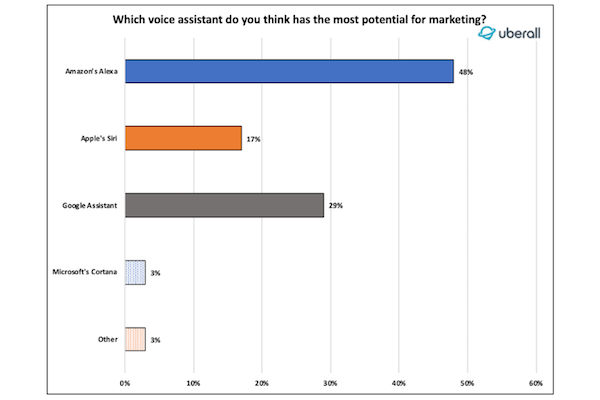

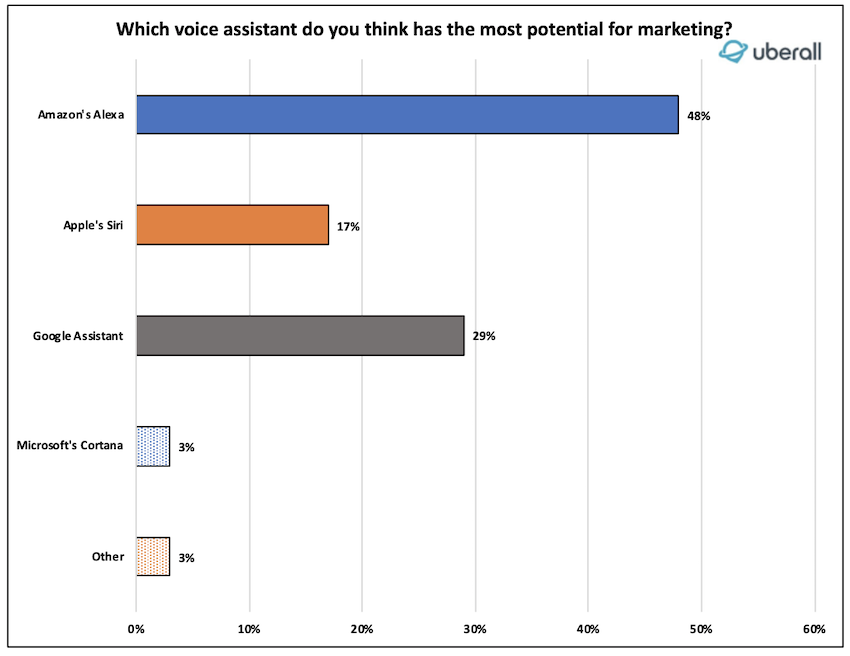

Nearly Half of U.S. Small Businesses Say Alexa Has Best Marketing Potential Among Voice Assistants Followed by Google Assistant

- 48% of U.S. SMB marketers say Alexa has the most potential for marketing among voice assistants followed by Google Assistant at 29%.

- Apple Siri at 17% has a strong showing despite its low penetration of smart speaker sales.

- Over 60% of SMB marketers say they have done something in voice (likely voice search) and 26% say they expect it to be “very valuable”

- 53% of SMB marketers say more clarity around ROI could help justify higher spending in voice marketing

According to a new survey by Uberall, 48% of 300 small and medium-sized business (SMB) marketers in the U.S. say Amazon Alexa has the best marketing potential among voice assistants. Google Assistant was identified as having the most potential by 29% followed by Apple’s Siri at 17%. Microsoft’s Cortana barely registered at 3%.

When we asked which mainstream voice assistant SMB marketers think has the greatest marketing potential the results heavily favored Amazon’s Alexa.

The higher expectations of Alexa over Google Assistant are likely founded in Amazon’s higher smart speaker market share in the U.S. according to Uberall. Voicebot data show that Amazon Echo products still command over 60% installed base market share in the U.S. despite inroads by Google in 2018. When you consider market share differences, Alexa actually underperforms in terms of marketer expectations of impact and Google slightly overperforms when looking just at smart speakers.

If you take a more expansive view of voice assistants and include mobile and the car, Google’s dominance in search and large smartphone installed base easily explains why its expectations exceed smart speaker market share. The real outlier here is Apple’s Siri. From a smart speaker perspective, HomePod is now less than 4% of the U.S. installed base, but iPhone accounts for nearly half of smartphones. This is where Apple is most likely to have an impact and many SMB marketers must be attuned how that is likely to develop.

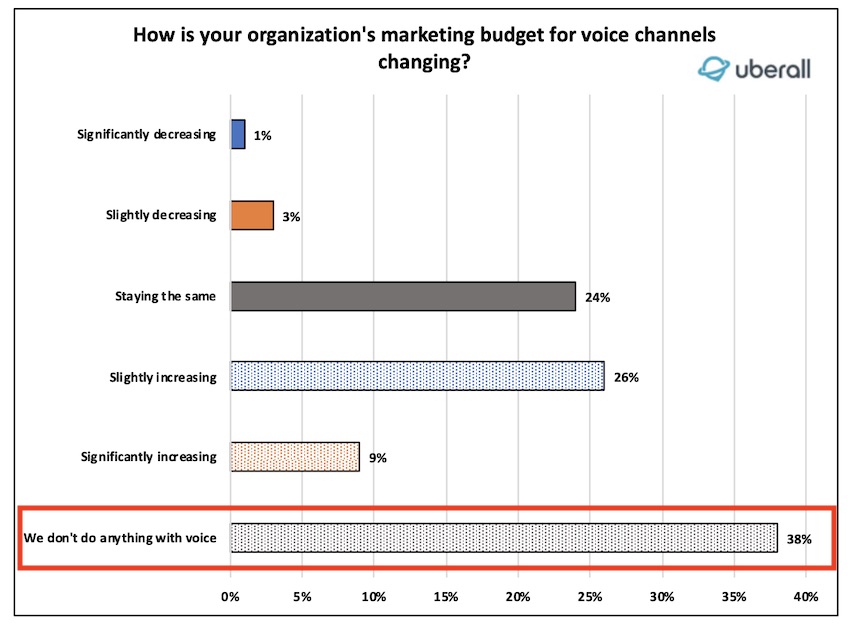

Over 60% of SMBs Say They are Doing Something in Voice Today

Maybe the more surprising figure is that only 38% of SMB marketers said they were doing nothing with voice today. That means more than 60% say they are doing something. It may be that some of the SMB marketers have online voice search optimization programs in place and are not referring to actual voice assistant initiatives in their response. The U.S. census bureau says there are over five million SMBs in operation and we clearly don’t have that many Alexa skills and Google Actions in use.

Uberall points out that over one-third of SMB marketers plan to increase their investment in voice marketing and almost none expect a decrease. However, the report also highlights that investment levels are likely small today and therefore decreases are unlikely to have an impact. One in four SMB marketers did indicate that they believe voice marketing will be “very valuable” to their businesses.

ROI Metrics are Key to Expanding Voice Marketing

When asked what factors would spur their companies to invest more in voice marketing, the top response at 53% was “better insight into campaign success and ROI.” That was followed by 47% that wanted more insight for campaign targeting and 33% that indicated technology complexity in voice marketing was a barrier. The viewpoint clearly indicates a focus on using voice for performance marketing as opposed to brand building efforts.

You can download the full survey report here. The bottom line is that SMB marketers in the U.S. have likely done very little to date with voice, but have a positive attitude about its long term impact.

Follow @bretkinsella Follow @voicebotai

Juniper Forecasts $80 Billion in Voice Commerce in 2023, or $10 Per Assistant