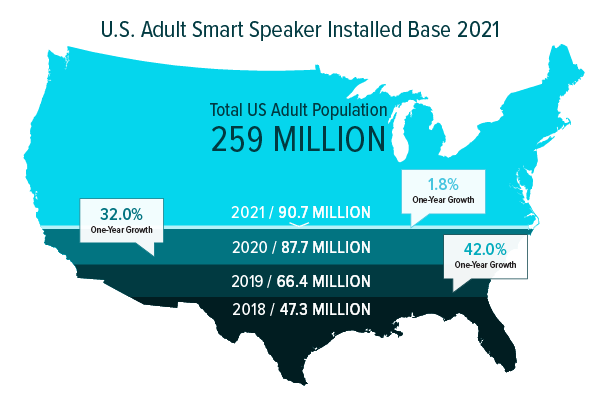

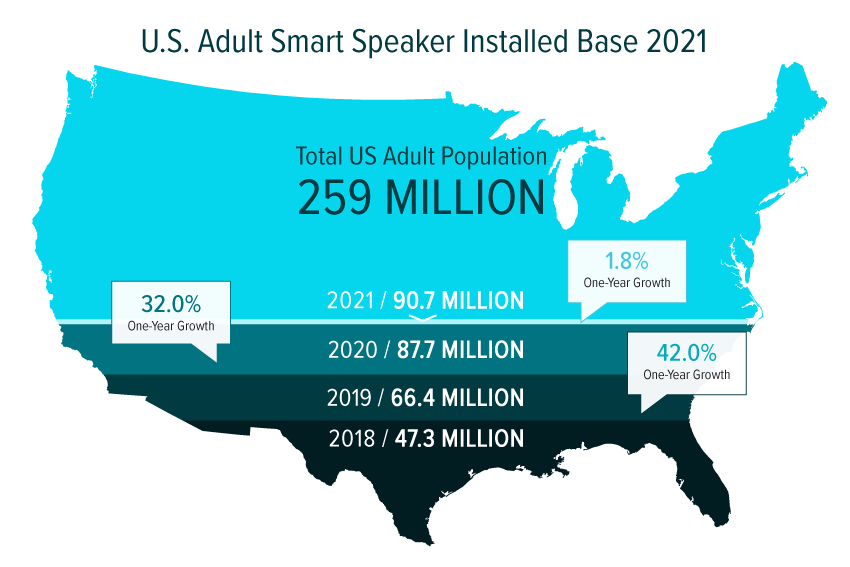

U.S. Smart Speaker Growth Flat Lined in 2020

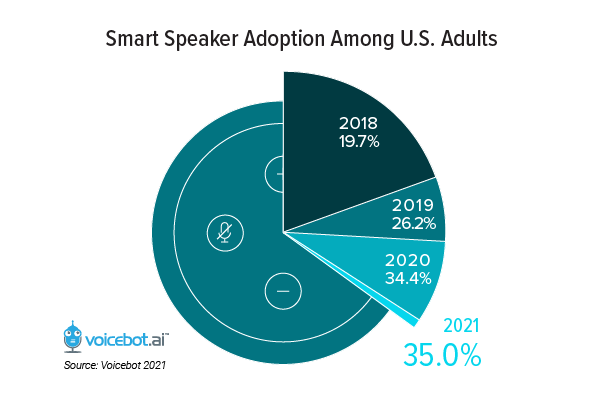

- Smart speaker adoption now exceeds 90 million users at 35% of the U.S. adult population

- The smart speaker adoption growth rate plummeted in 2020 to 1.8% following 32% the year prior

- Pandemic-related spending pullbacks and supply chain issues combined with lower consumer interest to stall market growth

Voicebot’s U.S. Smart Speaker Consumer Adoption Report 2021 reveals a dramatic slowing in the growth of new U.S. smart speaker owners. To be clear, there were three million more U.S. adults with smart speakers in January 2021 than a year earlier. The data reflects the first time that over 90 million U.S. adults reported access to smart speakers. However, the new figures reflect only a 1.8% growth rate compared to the year previous two years of 42% and 32% according to a January survey of 1,530 U.S. adults by Voicebot.ai.

No Longer Faster Than iPhone Growth

At one time, many people were fond of claiming that smart speaker adoption rates exceeded that of the iPhone. The adoption rate has exceeded nearly every consumer electronic device but it has not outpaced iPhone adoption rates for the past couple of years. Results from 2020 will likely end those comparisons even though smart speakers are still a tremendous consumer device success story. Smart speakers are increasingly a central feature of many American’s daily lives. They just are not as central as consumers have made smartphones in their lives.

New Report About Smart Speaker Adoption

The new report includes over 30 pages of analysis, 35 charts, and hundreds of other data points. Some of the charts in the report include:

- Smart Speaker Adoption Among U.S. Adults – 2021

- U.S. Smart Speaker Market Share by Brand – 2018-21

- U.S. Smart Speaker Market Share by Device – 2021

- U.S. Smart Display Market Share – 2021

- Smart Speakers Owned Per U.S. Household – 2018-21

- Where Consumers Have Smart Speakers in 2021

- Impact of COVID-19 Pandemic on Smart Speaker Usage

- Consumer Interest in Accessing Customer Service Through Smart Speakers

- How Smart Speaker Owners Discover Voice Apps – 2018-2021

- Third-Party Voice App Users – 2021

- Concern About Smart Speaker Privacy Risk – All U.S. Adults 2018-21

- Concern About Smart Speaker Privacy Risk – Smart Speaker Owners

- Reason Consumers Don’t Yet Have a Smart Speaker

- Smart Speaker Purchase Intent – 2018-21

- And many more…

Smart Speakers and the Pandemic

Consumers that already owned smart speakers reported higher device usage precipitated by the pandemic-induced stay-at-home orders. Being stuck at home did not, however, motivate consumers without smart speakers to make their first device purchase. Voicebot had noted in the 2020 Smart Speaker Consumer Adoption Report that consumer purchase intent around smart speakers had declined and that was before the global pandemic took hold.

The economic uncertainty, followed by a global chip shortage and supply chain disruption reduced the aggressive discounting in the fall holiday shopping season that was common in earlier years. Typically, about half of all smart speakers sold annually occur in the calendar fourth quarter. There were definitely smart speakers sold during the period but the vast majority were sold to existing device owners according to Voicebot survey data. All of these factors together resulted in an anemic expansion of the U.S. smart speaker user base in 2020.

Despite slowing growth, 35% of U.S. adults now own a smart speaker. That is up from about zero at the beginning of 2015 and 19.7% in January 2018. There are a lot of smart speaker users in the U.S. and they increased their device use in 2020. It is a rare situation where a new consumer electronic device reaches this level of adoption in about five years from the real beginning of sales expansion for the category. Amazon and Google have tremendous reach into U.S. households because of these devices that are slowly changing consumer behaviors around digital services consumption.

User base expansion is not expected to return to the rapid growth of 2016-2020. That is a key reason why you are seeing Amazon and Google focus more on driving more regular use of smart speaker features and highlighting the value of the voice assistants across other surfaces such as mobile and in the car.

To learn more about these trends and others, check out the Smart Speaker Consumer Adoption Report for 2021.

Download Report

Follow @bretkinsella Follow @voicebotai

Voice Assistant Use on Smartphones Rise, Siri Maintains Top Spot for Total Users in the U.S.

Marketers Assign Higher Importance to Voice Assistants as a Marketing Channel in 2021 – New Report