Smart Speaker Sales Decline in China in Q1 Due to COVID-19 Impacts But Country Market Share Rose in 2019

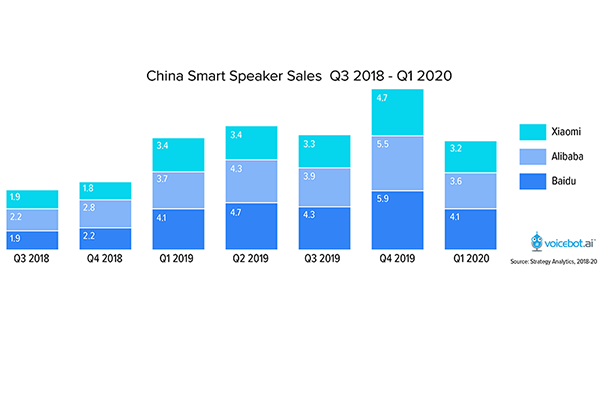

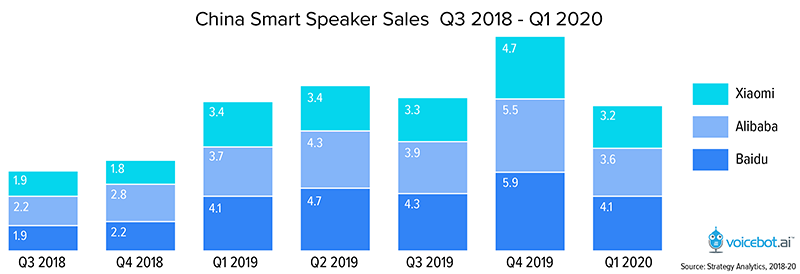

Strategy Analytics data show that China smart speaker sales fell between Q1 2019 and Q1 2020 by 300,000 units. The research firm attributes the fall to Coronavirus related impacts saying, “The global shares of Chinese vendors Baidu, Alibaba and Xiaomi all decreased as they faced supply and demand challenges in the Chinese domestic market as a result of pandemic-related measures. In Q2 2020, however, Chinese supply chains have been returning to normal and the Q2 shares of Chinese vendors will rise again.”

The Q1 year-over-year decline comes after sharp rises in quarterly performance during Q3 and Q4 2019. The increase in smart speaker sales in those quarters over 2018 was 92% and 137% respectively. An expected Q2 recovery reflects the fact that few smart speakers from Chinese manufacturers are purchased outside the country. As the U.S. and Europe face tougher market headwinds in the second quarter when many stay-at-home quarantine orders have been in effect and joblessness has reached all-time highs, China will largely be unaffected by these circumstances.

It is fair to say that the more important factor in China will be economic uncertainty. However, China is likely to be less impacted in smart speaker sales from a global economic slowdown in part because its smart speaker by-and-large are lower priced on both a nominal and relative basis than in the U.S. and Europe. In addition, China is earlier in its smart speaker adoption cycle so there is simply more room for growth.

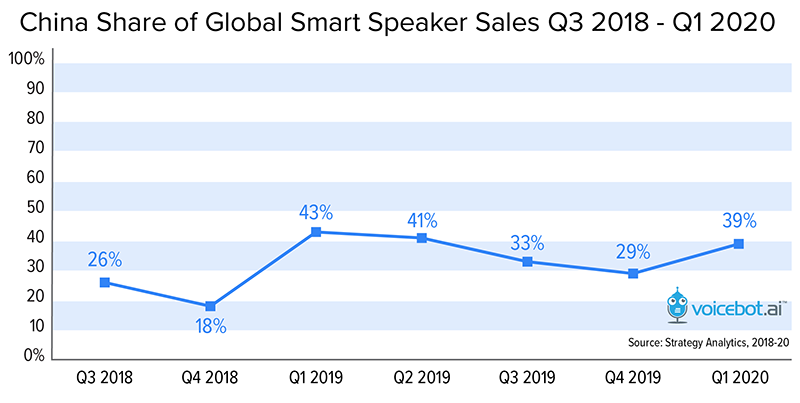

China Share of Global Smart Speaker Sales Up in 2019

Another interesting detail in Strategy Analytics global smart speaker sales data is the percent commanded by Chinese device brands. The total proportion of smart speaker sales coming from China rose over the past five quarters and has fluctuated between 29-43% compared to 18-30% in 2018. It is likely that China will consistently exceed one-third of smart speaker sales globally over the next several quarters.

Strategy Analytics data reinforces that the global smart speaker market structure is divided into China and the rest of the world. Few Western companies sell smart speakers in China and few Western consumers purchase smart speakers from Chinese brands. The dynamics within each of these markets are surprisingly similar with the key difference that China has three manufacturers well ahead of all other rivals while the U.S. and Europe currently have two.

Follow @bretkinsella Follow @voicebotai